Charlie Bilello put together a good piece that looked at the shortfall in GMO’s approach, yet I think the takeaway is a bit misguided.

Specifically, I am going to use an analogy to paint a picture and make my point.

Wilt Chamberlain once scored 100 points in a basketball game. This was an extraordinary set of circumstances, and it took an extraordinary performance, yet Wilt set the all-time NBA scoring record for most points in a game by a single professional basketball player. To me, this performance, was equivalent to the 1999/2000 U.S. equity market. Everything had to play out in a certain way for the event to occur. Building on the narrative, I never thought we would see something equivalent.

Yet, over the course of the current bull market, from March of 2009 to today in the United States equity market, the extraordinary set of events and circumstances has happened on an even larger scale, and to me, it is the equivalent of someone scoring 120 points in a basketball game today, topping Wilt’s record.

Could someone score 120 points by themselves in a NBA basketball game today when very few professional NBA teams even score 120 points in a game on a regular basis?

Yes, they certainly could, if everything lined-up, yet it would take an even more extraordinary set of circumstances and events.

Would you bet on someone scoring 120 points in an NBA game today? Probably not, as it is a very low probability event, and no matter the payoff, and how you scaled your bets, betting on a NBA player scoring 120 points in a game would likely lose money, unless something very unusual happened.

Tying this all back to today’s markets, the run over the past decade is something that hardly anyone could see coming, yet just because it happened, this does not mean that we should bet on this sequence of events happening, nor, if we could go back in time, should we have bet on the sequence of events unfolding as they have done.

What has played out in the U.S. equity market was always an extremely low probability event.

Just because that event happened, that does not mean that the forecasts of valuation centric market historians like GMO should be thrown out for having no predicative power.

Rather, we should all strive to understand the uniqueness of what has happened.

In my opinion, the opposite is happening, as the wrong lesson is being taken away, specifically that we are better saying we “do not know”, which is true in a way, but it is encouraging investors and speculators to bet on low probability outcomes. Additionally, the takeaway and the conclusion is encouraging investors to ignore valuations today, since if we got a historic run of equity returns over the past decade, why could it not continue?

The reason that the historic run in equity performance in the U.S. cannot continue, is that much like basketball, there are rules to the game.

In basketball, the rules include a time limit, only a certain number of possessions, etc., so there is a theoretical maximum amount of points that can be scored, even under ideal circumstances.

These mathematical limits also apply to the markets, meaning there is only a certain amount of capital in the capital markets, companies can collectively only reach certain market capitalization’s, etc., so even under rare, extreme, ideal outcomes, equities can collectively only appreciate so far, as they too will have mathematical limits.

Have we reached the limits in today’s U.S. equity valuations?

This is impossible to know, yet what we do know, is that we have had a unique set of events to get here, including U.S. domination in technology, global capital flows being recycled to the United States, enormous stock buybacks, record low interest rates, and last, but not least, a historic move from active to passive investing, which has concentrated capital in the market’s biggest companies.

The better lesson, in my opinion, is to recognize the uniqueness of what has happened, appreciate it, and say that is unlikely to happen again, because the event was so rare.

Said another way, could U.S. equities continue melting higher for a sustained period of time?

Yes, of course, there is a chance that could happen, however, it is extremely unlikely that we will witness historical equity returns going forward, as the starting point is so high, and the unique set of events is now largely in the rear view mirror.

Instead of normal equity returns from today’s staring point, the high probability outcome right now is very little real returns, or even negative real returns for a sustained period of time, particularly for traditional stocks and bonds, over the next decade.

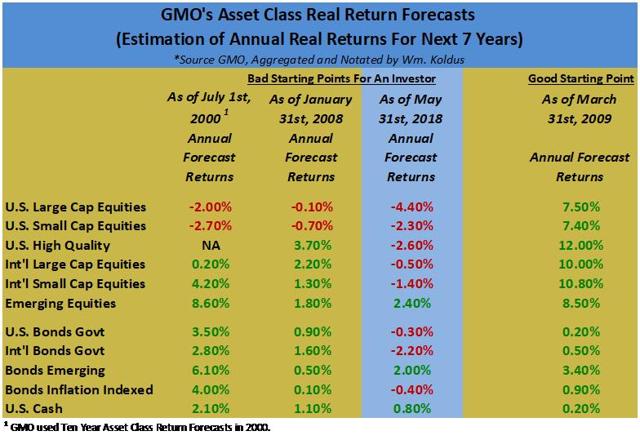

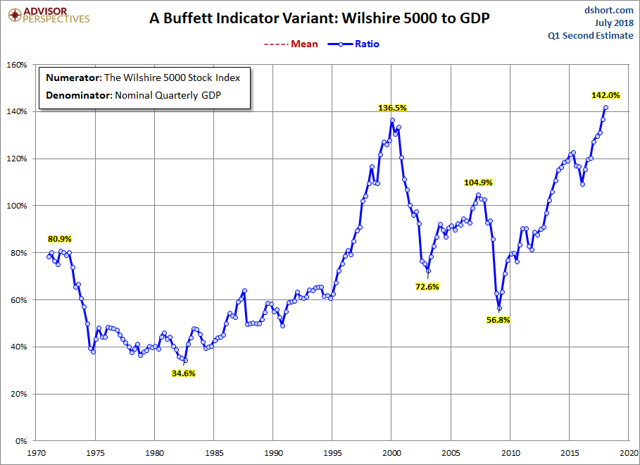

In closing, I am showing a table of GMO’s estimated annual real returns going forward, along with the Wilshire 5000-to-GDP ratio, as this table and graph provide a perspective on today’s elevated market valuations.

The GMO expected table of real returns I put together above, and the Market-Cap-To-GDP Ratio, are two barometers that show that real returns are likely to be challenged, at best, in the U.S. equity market going forward.

The GMO expected table of real returns I put together above, and the Market-Cap-To-GDP Ratio, are two barometers that show that real returns are likely to be challenged, at best, in the U.S. equity market going forward.