- The U.S. Dollar Index has rallied this year.

- However, the Dollar Index has not made new highs on its recent rally.

- Additionally, the Dollar Index remains materially below its 2015-2017 highs. What does this mean?

The U.S. Dollar (UUP) has rallied in 2018.

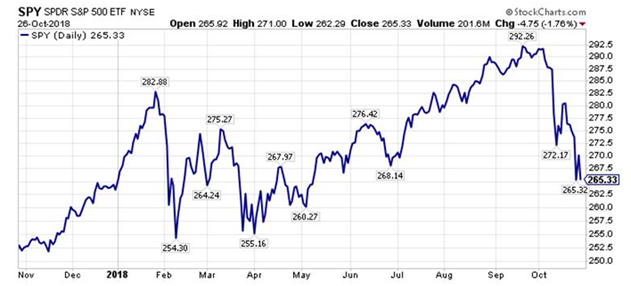

However, if you look at the chart above, it is interesting that the U.S. Dollar Index has not made a new high this year, even with all of the recent tailwinds, including a sharp downturn in U.S. equities, shown by the SPDR S&P 500 ETF (SPY) below.

Additionally, looking at the bigger picture, the U.S. Dollar Index, even with its recent rally, remains substantially below its 2015-2017 highs, as the longer-term chart shows in the following frame.

Interesting, to say the least.

Interesting, to say the least.

If the Dollar cannot make new 2018 highs with all the recent tailwinds, and remains materially below its 2015-2017 highs, what does that mean?

Is this a positive leading indicator for equities that would rally on Dollar weakness, including emerging market equities (EEM), developed international equities (EFA), international financials (EUFN), commodities, and commodity equities?