- 2021 year-to-date Model Portfolio performance has been exceptional, following a banner 2020. In aggregate, our model portfolios have trounced the S&P 500 Index since their December 2015 inception.

- Through March 5th, 2021, the Best Ideas Model Portfolio was up 36.8% YTD, ahead of SPY’s 2.6% YTD return. The Best Ideas Model Portfolio was higher by 51.1% in 2020.

- The Stuck On Yield Model Portfolio is higher by 28.0% YTD, and this Portfolio is now ahead of the S&P 500 Index since its February 21st, 2020 inception.

- Our long/short model Portfolio, which we call The Contrarian All Weather Model Portfolio, is up 19.7% in 2021 through March 5th, 2021.

- Last, but not least, Uncle Tony’s Model Portfolio, which was funded in August of 2020, has gained 32.7% YTD in 2021, and is ahead of SPY by a greater amount since inception.

“On the day that I die, I wanna say that I, Was a man who really lived/loved and never compromised.”

-Zac Brown Band from Day That I Die

Introduction

First, I want to say thank you for the folks along this journey, which has not been an easy one. even though it has been a very profitable one for those who had the endurance, patience, and fortitude to stick with positions that were very different than the broader market indices. Second, last week, for the week ending 3/5/2021, we saw another banner week for our targeted equity positions and our model portfolios.

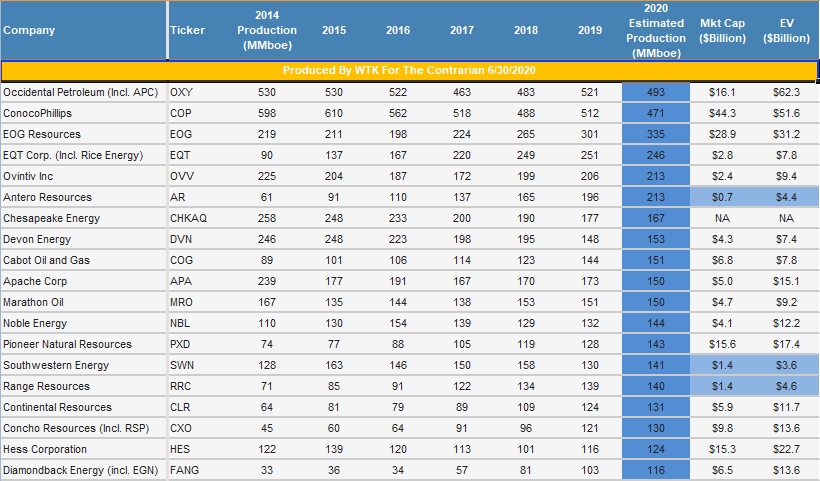

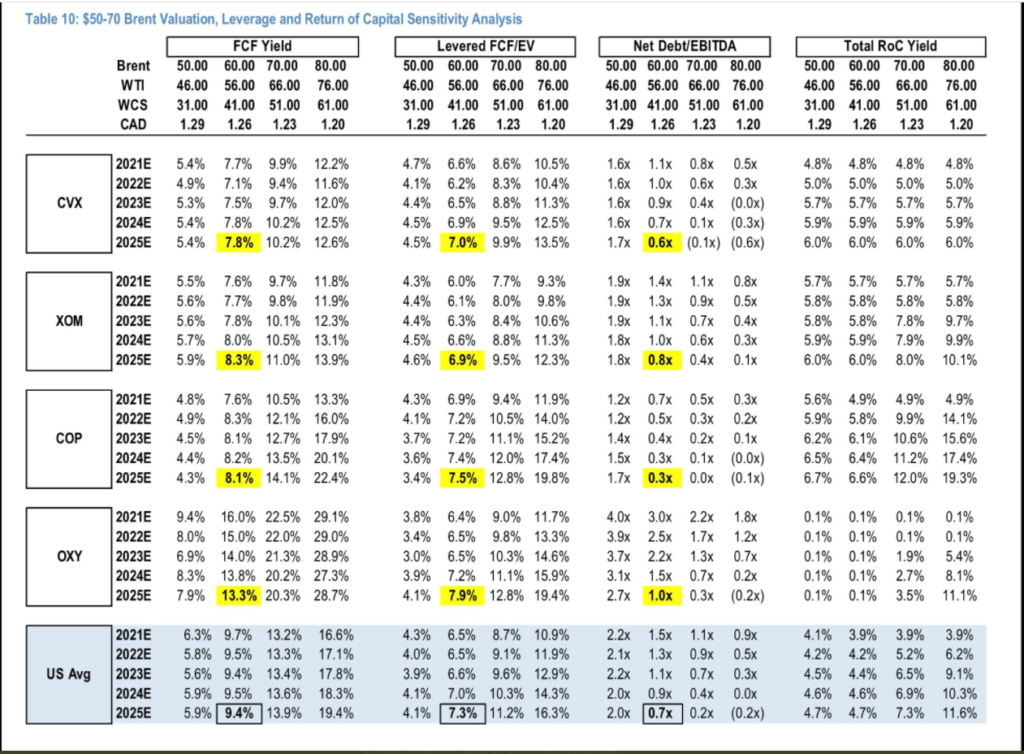

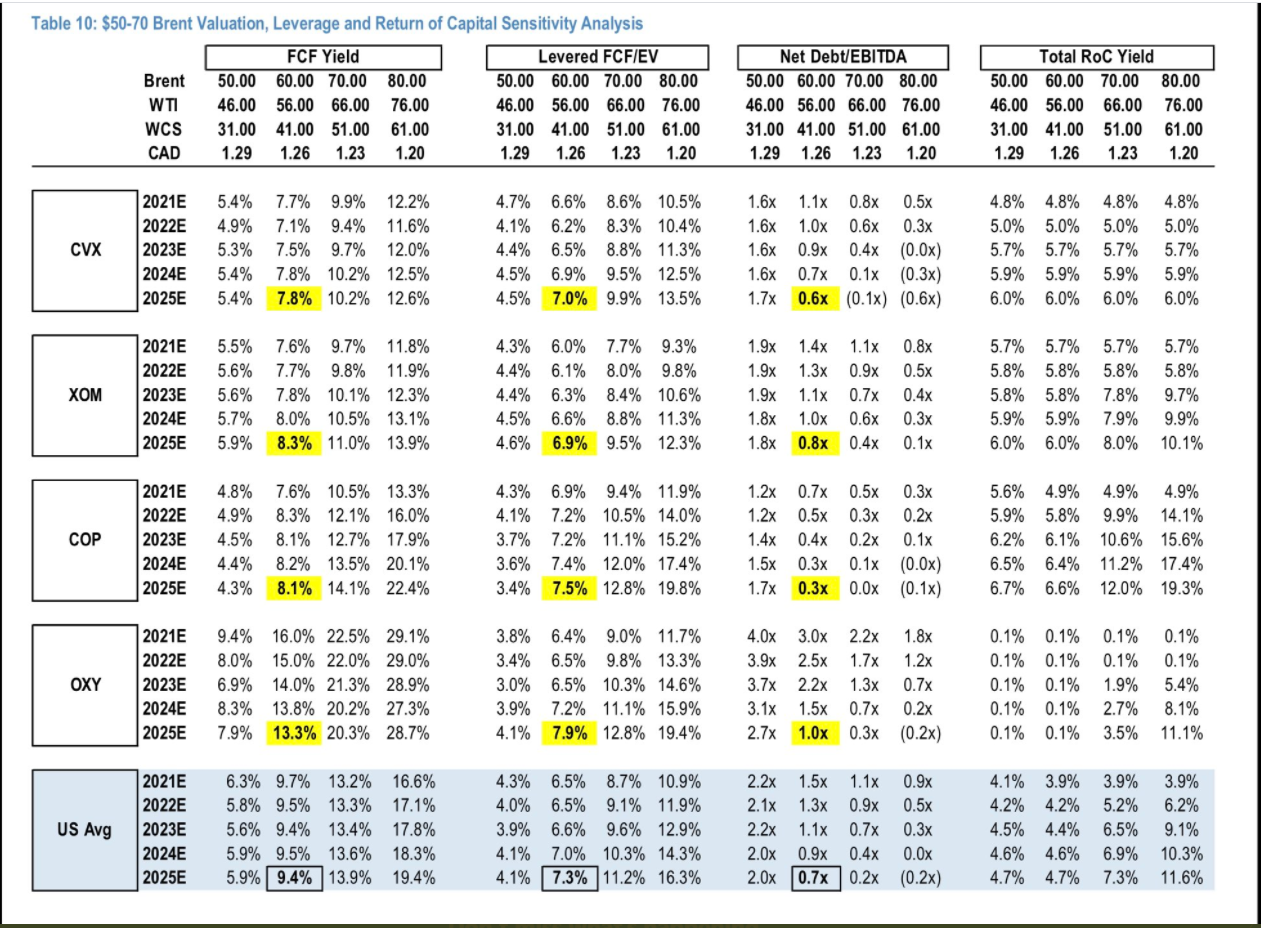

Occidental Petroleum (OXY), which I wrote about in this hotly debated “Too Cheap To Ignore” article, which was published on August 7th, 2020, saw its shares gain 17.4% last week (they are higher this week too). Since I wrote that article, OXY shares have gained over 100%, as of this writing, ahead of the SPDR S&P 500 ETF’s (SPY) gain of 18% over the same time frame.

Building on the narrative, OXY shares sport impressive free cash flow yields at today’s prevailing oil prices.

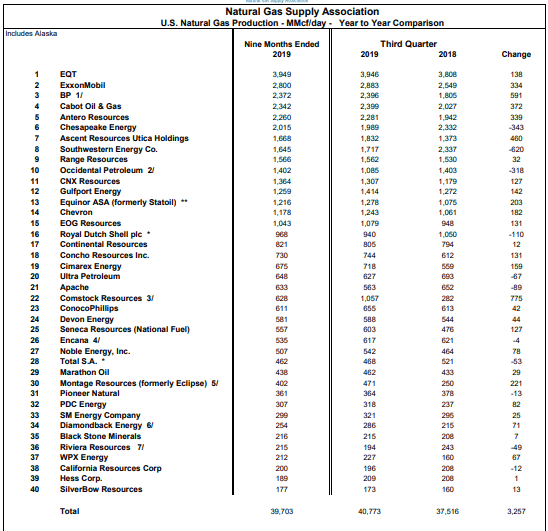

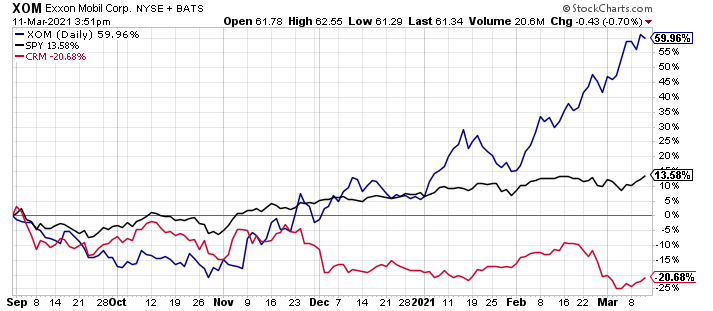

Continuing the narrative of out-of-favor energy companies, Exxon Mobil (XOM) shares, which are also featured in the table above, gained 12.1% last week, for the week ending March 5th, 2021. Since Exxon Mobil was removed from the Dow Jones Industrial Average (DIA) on August 31st, 2021, its shares have significantly outperformed Salesforce.com (CRM), which replaced Exxon in the DJIA.

I wrote about this outperformance in a public article published last week, titled, “Exxon Mobil Far Outpacing Salesforce.com Since It Was Removed From The Dow“. This article was a follow-up to one of my favorite articles I have written, which was titled, “Exxon Mobil Exit From Dow Reveals S&P 500 Index Structural Flaws.”

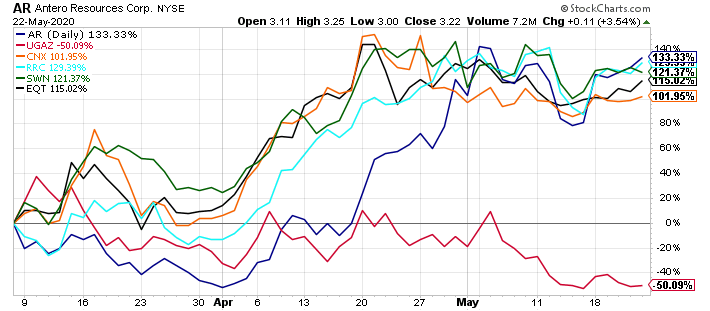

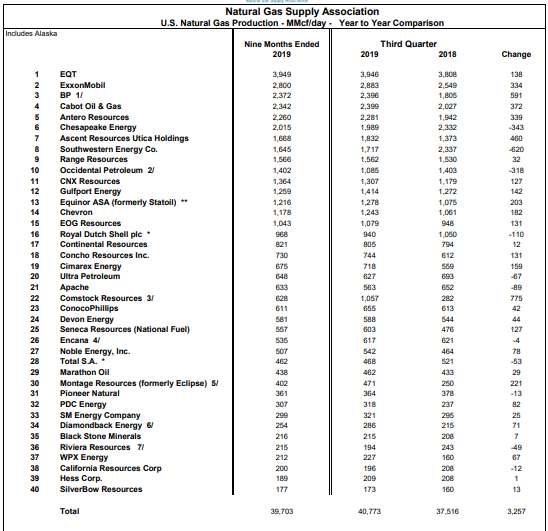

Also contributing to the outperformance last week was Antero Resources (AR), which I cover prominently in our dream scenario member articles at The Contrarian, and in a series of private and public research, including this recent article, saw its shares gain 9.8%. As I write this post, Antero shares are up 92.8% year-to-date in 2021, after gaining 91.2% in 2020. Members at the Contrarian have documented gains, for those who have reported, of over $80 million in Antero Resources alone.

There were many other equities that contributed to the positive model portfolio performance during the week ending March 5th, 2021. These included Devon Energy (DVN), whose shares gained 18.9% last week, Cenovus Energy (CVE), whose shares gained 10.8% last week, BP (BP), whose shares gained 9.7% last week, U.S. Steel (X), whose shares gained 9.3% last week, and whose shares are up over 111% versus a roughly 10% gain in SPY since I wrote the public article, “U.S. Steel: Too Cheap To Ignore Again“, on November 13th, 2020, Chevron (CVX), whose shares rose 9.0%, and Antero Midstream (AM), whose shares rose 7.3% last week, after being the best performing midstream firm for much of 2020.

There were a host of other equities that contributed to strong model portfolio performance, including quite a few financials, led by Barclays (BCS), whose shares gained 8.2% for the week ending March 5th, 2021, and Brighthouse Financial (BHF), whose shares rose 5.5% last week.

These are just a few of the equities highlighted that we cover, and who contributed to the positive performance. There were down weeks too, for stocks like First Solar (FSLR), whose shares fell 9.0% last week, RH (RH), whose shares fell 8.4% last week, yet are higher by 1383% since we bought these in the long/short Contrarian All Weather Portfolio in October of 2016, and Brookfield Renewable Partners (BEP), whose shares declined 8.1% last week.

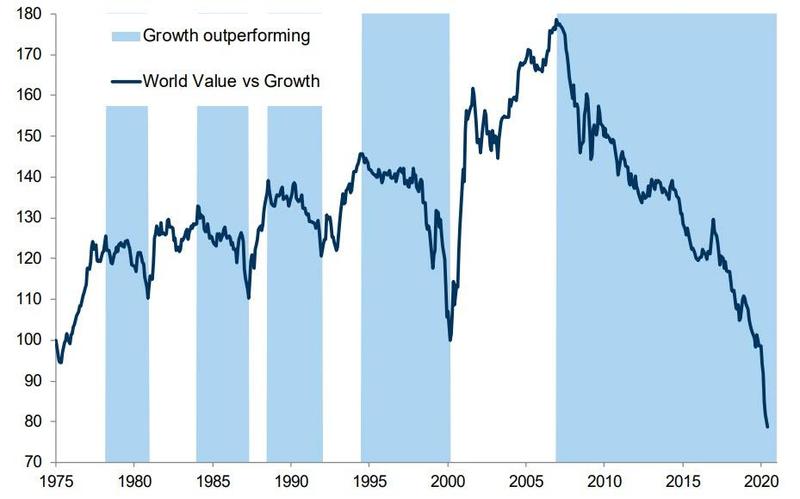

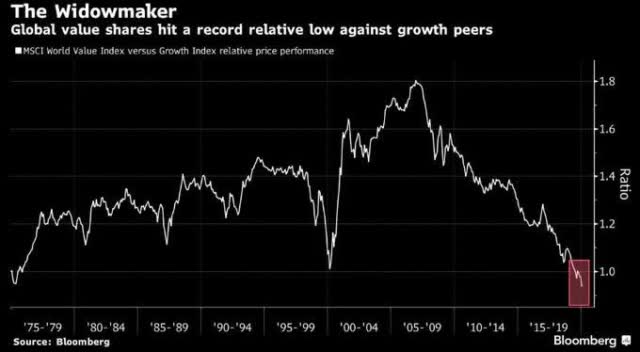

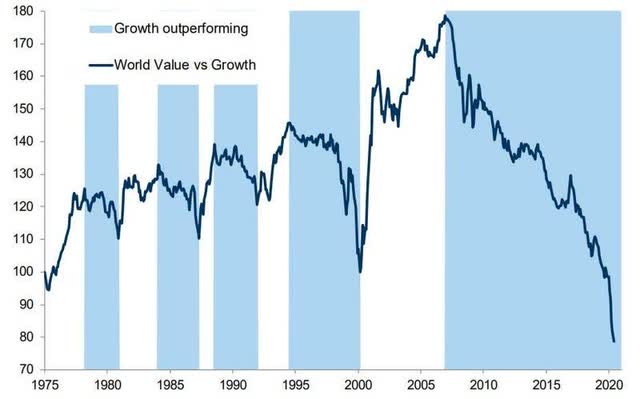

In summary, a historical capital rotation is in full bloom, something I have outlined privately, and publicly.

- “A Historic Capital Rotation Is On Tap” – Published October 18th, 2020

- “A Historic Capital Rotation Is Happening Hidden In Plain Sight” – Published November 25th, 2020

- “The Historic Capital Rotation Is Continuing” – Published December 4th, 2020

Understanding the bigger picture, then having the understanding of the bottom-up fundamentals (link to an important member article) has been the key, and it has not been easy, yet that is where the historic opportunity has been, and that is where it still stands, from my perspective.

Model Portfolio Performance Through March 5th, 2021

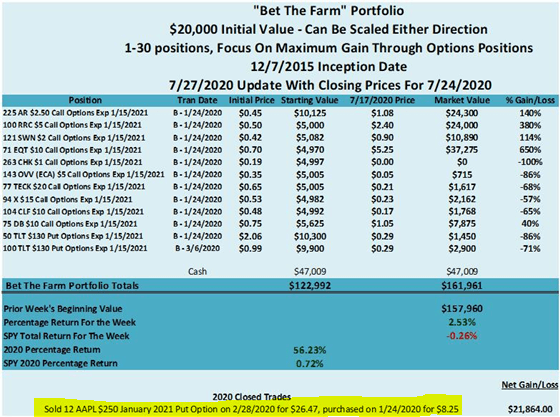

Bet The Farm Model Portfolio

- 2021 – Up 69.1% YTD (this portfolio has been all cash for a little while now)

- 2020 – Up 161.1%

Best Ideas Model Portfolio

- 2021 – Up 36.8% YTD

- 2020 – Up 51.1%

Stuck On Yield Model Portfolio (Inception February 21st, 2020)

- 2021 – Up 28.0% YTD

- 2020 – Down 6.0%

Contrarian Long/Short All Weather Model Portfolio

- 2021 – Up 19.7% YTD

- 2020 – Up 13.3%

Uncle Tony’s Model Portfolio (launched August 21st, 2020 for a family friend with $650k looking at retirement)

- 2021 – Up 32.7% YTD

- 2020 – Up 12.4%

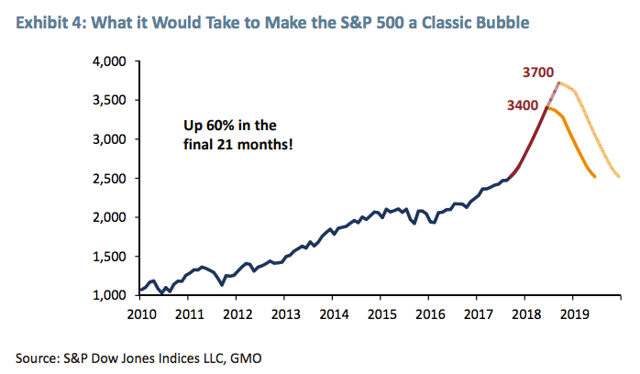

For perspective, the SPDR S&P 500 ETF is higher by 2.6% YTD in 2021 (through March 5th, 2021), and finished higher by 18.3% in 2020. For additional perspective, it has not always been rosy, particularly from 2017-2019, yet perseverance and understanding the bigger picture, along with bottom-up fundamentals has led to extremely strong relative and absolute performance since the inception of the model portfolios with the Bet The Farm & The Best Ideas Portfolios dating back to December 7th, 2015.

Member & Future Member Compliments

The success of others has been extremely gratifying to watch happen in real time, with a lot of naysayers drifting aside, yet still a fair amount of skepticism and criticism remaining. The following are a couple referenced newer member compliments and a couple of member compliments from 2020.

Exceptional work

“Unquestionably one of, if not, the best services on SA. The latter is what I’ll go with. That said, if you can’t have conviction in your thesis and ride (and add) when prices are working against you, this isn’t for you. Very grateful for this group and the community Travis created.“

– Posted As A Formal Review On January 24th, 2021

Life changing

“I have never written a review of an investing service, although been on the receiving end of many over a number of decades. The Contrarian stands out alone among them all. Travis brings integrity and intellectual honesty and deep and relevant experience, none of which I have found anywhere else. His insights are so perceptive that my lack of such vision caused me to take a high powered magnifying glass to his description of AR. I was highly skeptical and slow on the uptake. What I found, and reconfirmed from multiple angles, allowed positioning in March/April which has been life changing. Ideas presented are well worth investigating. Chat is incredibly helpful and noise free.“

– Posted As A Formal Review On January 21st, 2021

Separate the Forest from the Trees

“Travis is one of the best writers on SA in my opinion. He stays true to his value orientation and contrarian roots and has guided his subscribers towards very profitable investments through the years. In addition, the group of contrarians are active in sharing ideas, analysis and investment philosophy which are valuable to both beginner and expert investors alike. One word of caution, this is not a service which will provide daily trade ideas / signals nor dozens of in-depth single stock research (although key focus investments are covered in great detail); it is however an invaluable resource to gain insights in undervalued sectors, understand deeper industry and company fundamentals and ultimately unearthing deep, multi-bagger value investment ideas. It is not hyperbole for me to say that this service has changed my life. Absolutely worth the subscription 10x over.“

– Posted As A Formal Review On January 19th, 2021

Beconan Premium Comments2

@KCI Research Ltd.

“I want to thank you for your timely article on 2/19/2020 Antero Resources is A Generational Buy. Your article helped me reached a conclusion that AR would not file for BK. Soon after studying your article carefully, I started betting my farm ( funds from all my IRA accounts) on AR. 1/3 @1.83, 1/3 @1.40 and 1/3 @1.30. I accumulated about 500,000 shares of AR. Then AR fell to all time low of 0.67. A thought of cutting loss flashed in my mind. I overcame the fear eventually and stayed all the way up to now. Lately I ask myself where should I get off the moving train. Most target price mentioned is $17, some say $26, a new number mentioned is $50. I am going to try to get to $35 which is about 1/2 of all time high. I do not know if we can get there or not. I worked for McDermott for a year in 2002, a thousand dollar company matched stock in my 401K account grew to over $30,000 as company stock went from single digit to over $100 in a few years. That personal experience also helped me to decide to bet the farm.

You helped me and my wife to be able to retire comfortably and help my children go to Universities. Thank you so much. I will be your The Contrarian subscriber soon.“

– Posted January 13, 2021

myk3077 Premium Marketplace Comments96

“@ KCI research… I have been a member of your investing service for a couple of years. I want to share with everyone that Travis’ research going all the way back to 2018 is unbelievably outstanding. My knowledge has grown 5 fold in the space just from pouring over his previously published members only articles. The valuation work and detailed analysis of individual basin characteristics is second to none and to be honest.. is better than many professional energy consulting firms research reports i have read over this time. Simply put… Travis will probably be the single largest reason why i am able to retire early… His service is invaluable..and it doesn’t matter if you disagree with his research.. just having it to offset/make better investment decisions is the idea. There is nobody better at his size in the industry… The fact that unaccredited investors have access to him is truly unbelievable.“

– Posted January 13th, 2021

“And I want to thank you for the research, without which I wouldn’t have the conviction to concentrate my portfolio. It is up more than 200% this year. Very likely I will be able to retire in the coming year.”

– Member compliment received December 15th, 2020.

“I have accumulated over 96K shares from MAR 10th until 2 weeks ago (in Antero Resources shares). My average price is $1.67 (the stock was trading recently around $5 per share). KCI research is the reason for this… Its about the thoroughness of research that led me to have the conviction to jump in.. I simply added his analysis coupled with understanding the ramifications of the oil price war and Covid on the Energy Sector. I wrote this to thank KCI for his insight, research and investing service which is outstanding.”

– Member compliment posted here on December 8th, 2020.

“Before 2020, I thought it would have been crazy to pay over $1,000 for a subscription. Yet after reading one of Travis’ articles and a 2-week trial, I realized that the value offered here, vs other services, is substantially greater. I initially subscribed to The Contrarian for knowledge and if I made money, then great; I’ve become a better investor due to this close-knit group and the return potential has been far more extraordinary than I imagined coming into this year. The crazy thing is that things are just getting started, as financial markets are at relative extremes, rarely reached historically, according to The Contrarian’s analysis. Travis is not your typical go-with-the-flow investor, hence the group name, The Contrarian. The group focuses on the most undervalued sectors of the market that have outstanding growth opportunities and while our gains have been extraordinary this year, I am still in awe of the enormous future return potential. Here, you will find many highly competent investors contributing towards a variety of topics that will leave you learning something new every day. If you are looking for an author who is competent, respectful, formally educated, and thinks outside the box, then give The Contrarian a try – I’m glad I did, and my portfolio is happy too.“

– Member compliment posted as part of a formal review on August 27th, 2020

“Thanks for your input Travis. I must say you do have a very pragmatic and calming way of framing things and make some really good points. I don’t think I have ever come across anyone with so good hand holding skills regarding stock investments.”

– Member compliment posted on August 22nd, 2020.

“I completely agree that Travis’ style is calming, professional, poised and (positively) unique. It’s Travis’ style and professionalism (especially responding to rude responses in public articles) that really distinguished him (besides good research and a shared contrarian view) and attracted me to The Contrarian.

Travis enables counterpoints to be shared and, as he’s done here, actually encourages it. Iron sharpens iron and an echo chamber is dangerous. Many of us have very (probably irresponsibly) high portfolio percentages allocated to our favored names so I think it’s important for us to continue enabling these questions and this dialogue.“

– Member compliment also posted on August 22nd, 2020.

“I think of you as the Wayne Gretzky of analysts. A couple things I remember you saying that have happened – PM’s would lead the way higher for commodities in general, then E&P stocks would lead the way up before the underlying. We’re starting to see some strength in natural gas here recently. Things are looking pretty darn good to me.”

– Member compliment received on August 11th, 2020, and as a sports fan for most of my life, I appreciated the context.

“The investment commentary is first rate. Also, Travis has expert knowledge of the natural gas industry and specific high potential stock picks in this area. (Lots more besides.) All this builds confidence in his stock picks. Another real plus is the member chat area, which is full of really excellent ideas, observations, forecasts, etc. Am grateful to the lords of investments for allowing me to discover The Contrarian.“

– Member compliment was received on August 8th, 2020, and this was also posted as a formal review.

“I’ve been a subscriber to KCI’s research service and all I can say is that I wish I had done so sooner. Definitely the best of the 4-5 I’ve tried so far.“

– Member compliment was posted on August 7th, 2020.

“Having spent my career as a market research analyst, being surrounded by competent analysts, I observed what we might call the “analyst fallacy”. Indeed, I subscribed to The Contrarian despite a high price compared to other Seeking Alpha subscriptions, because it is explicitly anti-herd or orthogonal to the herd. Indeed, the more I study it, the more I find The Contrarian subscription price to be a relative bargain.“

– Member compliment posted in a series on July 30th, 2020.

As I like to say, the feedback, positive and negative, indicates that I am headed in the right direction with The Contrarian.

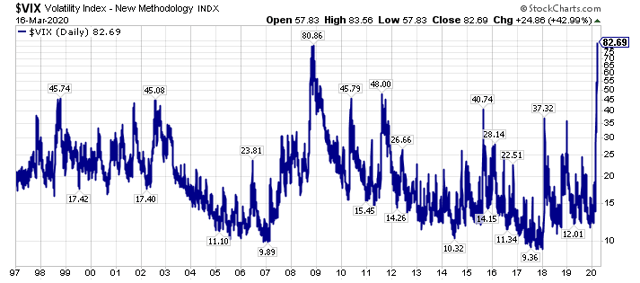

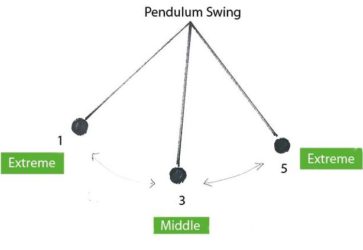

Closing Thoughts – Perspective & Perseverance Are Needed

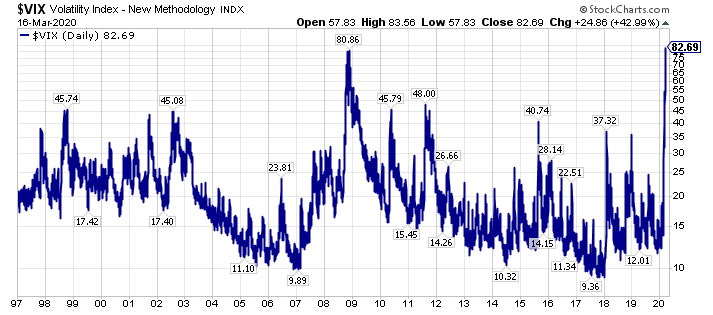

All the detailed spreadsheet models in the world are not a substitute for understanding the bigger picture, being able to position ahead of a move, and being able to look forwards instead of looking backwards or look forwards instead of focusing on the present situation. Ideally, getting the “macro” and “micro” right is what you want, however, this is hard to do in practicality, and there are going to be unexpected twists and bumps along the way. Said another way, investing is a full contact sport, and you have to be prepared for the mental and physical capital challenges if you want to materially outperform.

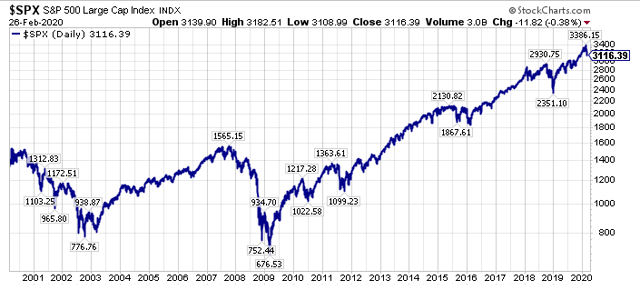

Ironically, right now, the best thing most traditional investors could do, meaning those that focus in traditional stocks, bonds, real estate, etc. is to take a vacation for the next seven years. I will be expounding on this topic more shortly (update, which I did here, and it is important to read the closing paragraphs for the true conclusion). Alternatively, investors who want to stay in the game should consider non-correlated and alternative asset classes.

For now, I am going to close with the same refrain I have been hammering in with these blog posts.

Many investors operating in the commodity equity arena have had to run a long/short portfolio to simply survive the past seven years, however, the irony today, is that the most operationally leveraged companies, which are generally the short positions in these aforementioned long/short portfolios, have the most upside return potential at historical inflection points.

We are seeing that right now, and two specific public examples that I have highlighted include U.S. Steel (X), which I wrote about here, and Occidental Petroleum (OXY), which I wrote about in this public article. If those two are too high octane for you to look at as a investor, consider Wells Fargo (WFC), which has some of the same out-of-favor characteristics, as I detailed in this recent article.

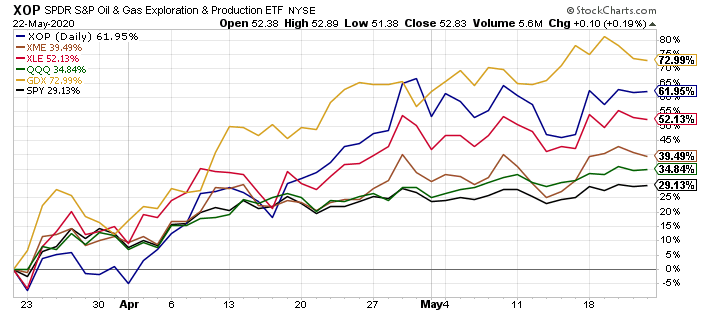

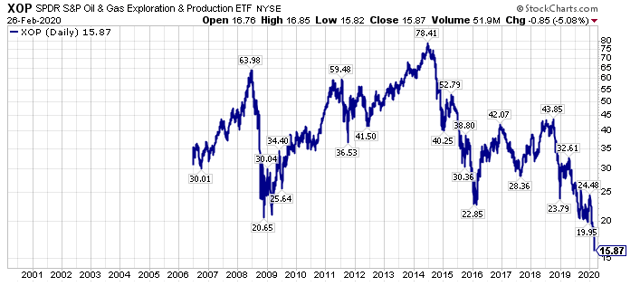

In summary, investors chase performance, that is just part of human nature, and many investors are chasing performance in the hottest sectors today, including the technology sector, even though energy equities (XOP), (XLE) at a broad lever are outperforming technology equities (XLK) over the past four months by a substantial margin. Having said that, market participants will generally not consider the out-of-favor equities today, even acknowledged industry leaders, until they have a long-run of outperformance.

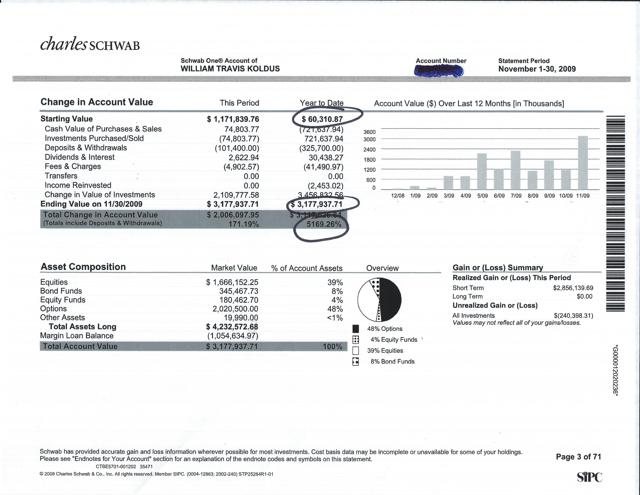

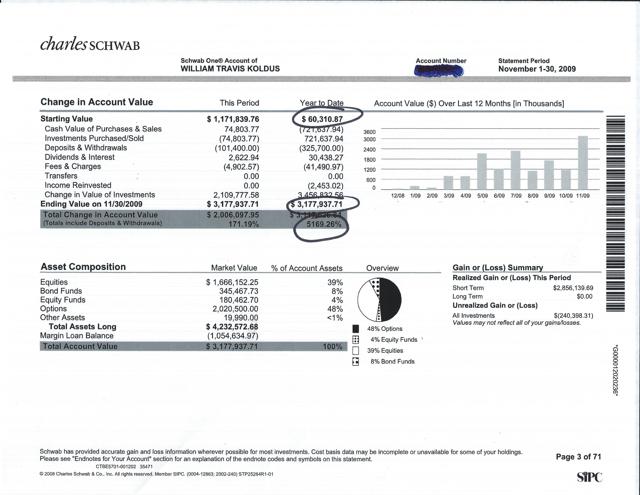

I witnessed this first hand with Realty Income (O), which I have written about this here, in late 1999 and early 2000, trying to sell this position as part of a portfolio in my role at Charles Schwab (SCHW) and Chicago Equity Analytics, yet very few investors would even consider it. This was the case, even though Realty Income shares had roughly a 10% dividend yield back then, and most investors have it as core holding today, with a dividend yield that is less than half what it was, and a narrowing growth runway after a twenty-year good run of strong performance.

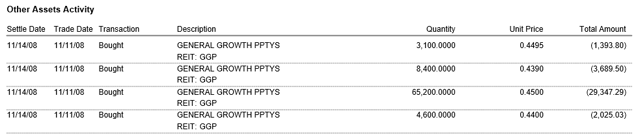

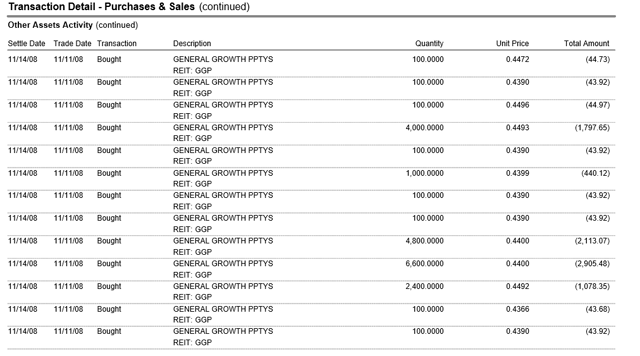

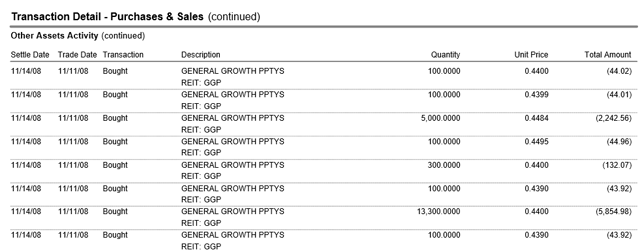

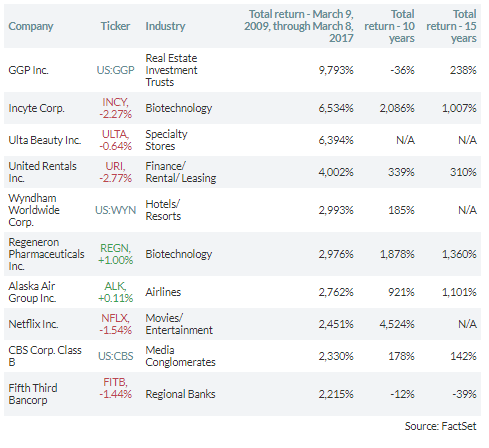

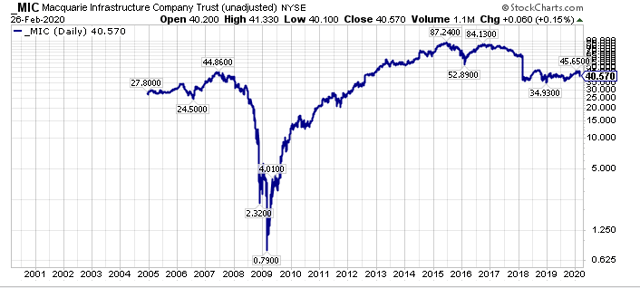

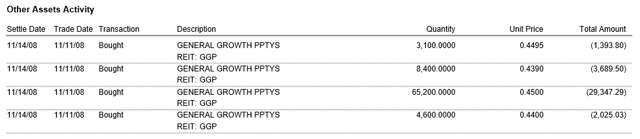

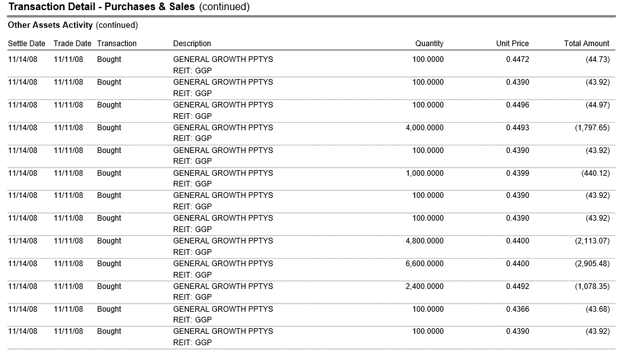

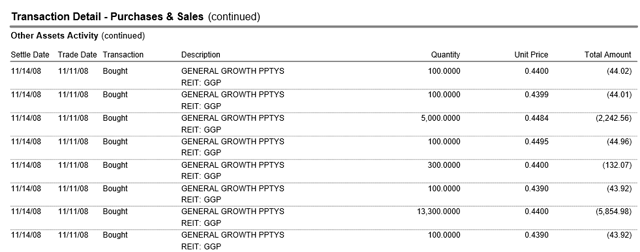

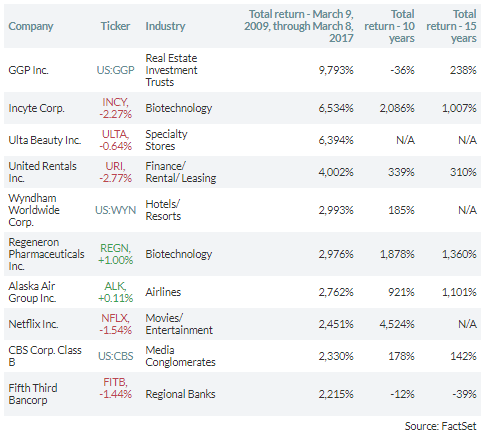

I also witnessed the same thing when I was buying out-of-favor REITs, specifically General Growth Properties, and First Industrial Real Estate (FR) in late 2008 and early 2009, which I chronicled in this article that I published on February 27th, 2020.

The key to build real wealth, IMO, is to own concentrated positions, ideally buying into panic selling, in the best outperforming companies of the next 20 years, not the best performing positions of the past twenty years.

We have been able to do this real time at The Contrarian.

For help in that endeavor to outperform, consider a membership to one of my research services. On that note, I am continuing to offer a 20% discount to membership (I am extending this through March of 2021 due to popular demand and my desire to help the greatest number of investors and then pricing will return to the normal levels, and then we will raise prices at some point to maintain the level of dialogue we have now) to “The Contrarian” (past members can also direct message me for a special rate). Remember, this compliment when it comes to pricing.

Indeed, I subscribed to The Contrarian despite a high price compared to other Seeking Alpha subscriptions, because it is explicitly anti-herd or orthogonal to the herd. Indeed, the more I study it, the more I find The Contrarian subscription price to be a relative bargain.

And this one on pricing too.

Before 2020, I thought it would have been crazy to pay over $1,000 for a subscription. Yet after reading one of Travis’ articles and a 2-week trial, I realized that the value offered here, vs other services, is substantially greater.

Additionally, I am offering a limited time 20% discount for the first 10 new members (I expect these slots, some of which I view as a stepping stone to “The Contrarian”, to fill up fast as they have done previously) to a host of research options, including a lower price point. If you subscribe to a premium option, I will set-aside time for a personal phone call to get up to speed. To get these offers, go here, and enter coupon code “march” without the quotes.

Reach out with any questions via direct message.

Via my research services, or another avenue, please do your due diligence, and take advantage of what I believe is a historic inflection point, which I believe will supersede 2000-2002, and 2000-2007, in the growth-to-value rotation.

Best of luck to all,

Travis

P.S. Resilience is perhaps the most important ingredient to be successful in life, and in the markets. Keep that in mind right now.

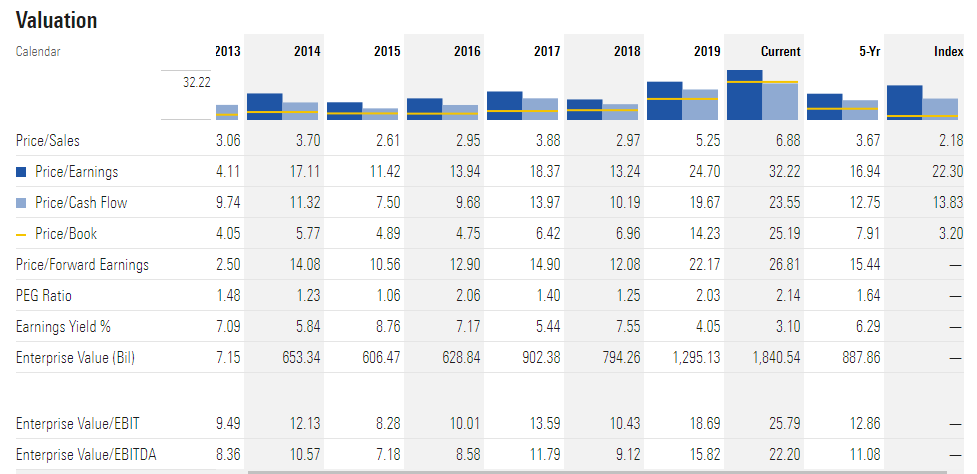

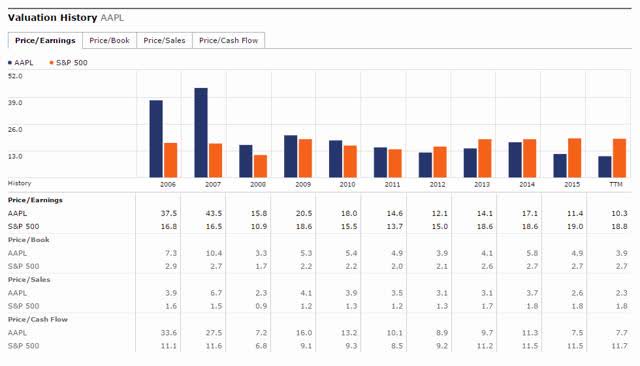

(Source: Author’s May 2016 Article, Seeking Alpha, Morningstar)

(Source: Author’s May 2016 Article, Seeking Alpha, Morningstar)