(Travis’s Note: This article was originally published on June 11th, 2018, and is being republished on October 28th, 2018 to add to the archives. The title of this article was called “Exiting Purgatory”, however, that was a premature assessment. Purgatory has continued for many out-of-favor equities, far longer than I would have thought two years ago, however, a historic rotation, even bigger than the reversal and rebound that encompassed out-of-favor equities in 2016 is on the horizon.)

- 2016 was terrific, one of my best years ever, and this emboldened me heading into 2017.

- The following 16 months might have been the worst period of my two decade plus investment career, and that is saying something, given the highs and lows I have achieved.

- During the past two months, prices of my targeted equities have synced up, once again, with the dominant investment narratives that have prevailed since 2016.

It is no secret that the 16 months spanning January of 2017 to April of 2018 brought me to my knees, and then some, after one of the best macroeconomic and bottoms-up research calls of my roughly two decade career.

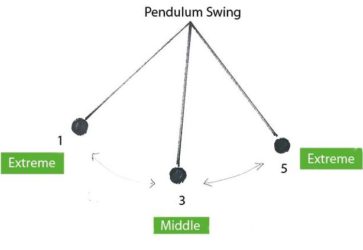

The investment markets, much like life, offer unexpected twists and turns, and they can humble us more than we can imagine.

As market participants, it is up to each one of us to learn, and benefit from our mistakes and successes.

Staying the course, I remain convinced that we are on the cusp of a generational investment opportunity, and there are valid reasons to be both extraordinarily bullish and extraordinarily bearish.

Last Thursday, I published an article for members, and as one part of the article, I looked at the performance of The Contrarian’s Top-Ten List from 4/5/18 through 6/6/2018.

With the equities names blanked out, here are the performance metrics over this time frame.

- Equity One – Gain of 6.6%

- Equity Two – Gain of 41.9%

- Equity Three – Loss of -25.0%

- Equity Four – Gain of 19.7%

- Equity Five – Loss of -19.9%

- Equity Six – Gain of 5.8%

- Equity Seven – Gain of 97.4%

- Equity Eight – Gain of 60.9%

- Equity Nine – Gain of 40.0%

- Equity Ten – Gain of 2.7%

Looking at the above list, clearly something has changed.

What has happened?

The short answer, is that purgatory is over.

Hope everyone is having a nice start to the summer,

WTK

Disclosure: I am/we are long the positions in the contrarian portfolios.

Additional disclosure: Every investor’s situation is different. Positions can change at any time without warning. Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author’s opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including detailed review of the companies’ SEC filings. Any opinions or estimates constitute the author’s best judgment as of the date of publication, and are subject to change without notice.