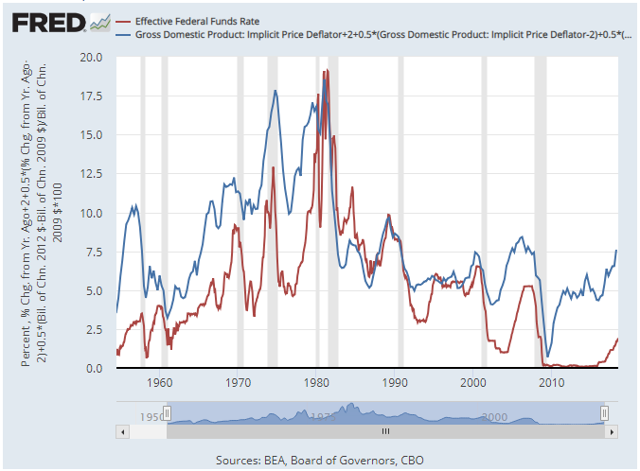

This week I was writing an article for the esteemed members of our group at WTK The Contrarian and, in the article, which discussed past interest rate cycles, and Fed monetary policy, and the future consequences of this monetary policy, I used the following chart, depicting current interest rates and what interest rates would be under the Taylor Rule.

Ever since I wrote about it earlier this week, I cannot stop thinking about this chart above.

Specifically, the Fed has been extraordinarily easy in their application of monetary policy over the course of the current bull market compared to a rules based approach, becoming even easier over the past year, as the accelerated pace of interest rate increases in the Fed Funds Rate has lagged the improvements in economic growth and in inflationary readings.

Look at the chart above again.

What would the Fed Funds Rate be under the Taylor Rule?

How about 7.5%.

For a variety of reasons, there is no way, I repeat “no way”, we are getting there, meaning to a 7.5% Fed Funds Rate. Adding to the narrative, this holding down of interest rates is similar to the aftermath of the 2000-2002 downturn, where monetary policy was kept extraordinarily easy (see chart above again), and this policy planted the seeds for the extraordinary price action in 2007-2010 in the financial markets.

We know what the implications of easy monetary policy in the prior era, including a historic bubble in U.S. housing prices, with the benefit of hindsight.

More importantly, what are the implications of this extraordinarily easy monetary policy today, and over the course of the current bull market?

I have some ideas, including what has spurred the record level of the S&P 500 Index (SPY) today, whose positive price action, in my opinion, is largely in the rear-view mirror, and what assets are largely undervalued given the monetary policy backdrop. The second point is what really matters going forward, and this is especially important given the challenging level of real returns going forward.

Interested in hearing what others in the SA community are thinking?

Hope everyone is enjoying the transition from the end of the Summer back to the school year. With more children than I can keep track of, I certainly appreciate this time of year,

Travis