(Travis’s Note: This article was originally published on October 20th, 2016, and is being republished on October 28th, 2018. The article highlights the Punch Card Portfolio Concept, originally derived from Buffett, which we talked about earlier this evening with the re-post of the Buy & Hold article, and this will be a regular topic going forward. Thus, this is a foundational article for members, in my opinion.)

- A look at John Hempton’s view on portfolio strategy and construction.

- What is the 20 punch card portfolio?

- Why is a long/short portfolio important as a core, which then can be surrounded by concentrated satellite portfolios?

In my reading, I have come to appreciate the musings of John Hempton, who runs Bronte Capital. The following piece has several nuggets of wisdom, including John’s take on Warren Buffett’s punch card approach to investing, which would limit the number of investments you could make in your lifetime to 20. Once these “punch cards” were used up, you would be out of investment choices. This would emphasize the importance of investment selection, not overtrading, and sitting on your hands, which has become one of my favorite investment expressions.

When thinking through my investment career, looking back through the rear view mirror over the past twenty plus years, I can see mistakes I made by overtrading and these were often, some of the costliest mistakes, as I bought attractive investments and then sold them too early. These so called mistakes often ended up being good, or great investments, but they were not the phenomenal returns that really impact portfolio returns and that could have been achieved by buying and holding these undervalued, contrarian opportunities.

Building on that narrative of the 20 punch card investment philosophy, if we could only make 20 investments starting today, which stocks would we buy? Are there any extraordinary candidates today, like Macquarie Infrastructure (NYSE:MIC) was in the spring of 2009? I have some ideas that I will share in the commentary section of the discussion. For now, enjoy John’s view on the topic, his take on portfolio construction, and his evolution as an investor, which has many parallels to “The Contrarian” Portfolios, including the importance of a long/short portfolio, which in our world is the Contrarian “All Weather” Portfolio.

Travis

P.S. Remember the importance of being patient and sitting on your hands! We have seen that lately in our investments.

Comments on investment philosophy – part one of hopefully a few…

This is the first of several investment think pieces I have in my head dealing with investment philosophy, where markets are now and maybe even a stock or two… They are surprisingly hard to write so these posts might come slowly…

—

When I was starting out in the investment game I read Warren Buffett’s letters from inception, Ben Graham, Phil Fisher, anything I could on Charlie Munger and the rest of the standard investing canon.

One thing that had a profound effect on me was Warren Buffett’s twenty punch card. ( Quoted here…)

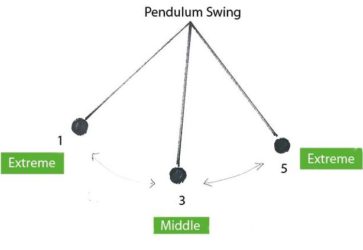

Buffett has often said, “I could improve your ultimate financial welfare by giving you a ticket with only twenty slots in it so that you had twenty punches – representing all the investments that you got to make in a lifetime. And once you’d punched through the card, you couldn’t make any more investments at all. Under those rules, you’d really think carefully about what you did, and you’d be forced to load up on what you’d really thought about. So you’d do so much better.”

Buffett is right. That would be a really good way to run your private investments – you would, I think, be very rich by the time you were old. And indeed Charlie Munger has run his career close to that way (though I suspect he is closer to 100 investments by now…)

Charlie Munger has quoted Blaise Pascal approvingly: “all of humanity’s problems stem from man’s inability to sit quietly in a room alone.

There are plenty of people out there who call themselves Buffett acolytes – and as far as I can see they are all phoneys. Every last one of them.

Find any investor who models themselves off Warren Buffett and look at what they do.

And look at their investments against a twenty punch card test.

They fail. They don’t even come close. Several big-name so-called Buffett acolytes have made more than three to five large investments in the last three years and at prices that can’t possibly meet the twenty punch card test. Most phoney Buffett acolytes have been turning stock over faster than that.

Warren Buffett’s two juniors (Todd Combs and Ted Weschler) have turned over many stocks in the past few years too – and at prices that don’t reconcile with any twenty-punch-card philosophy. They are phoneys too. Just a little less egregious than many other so-called Buffett acolytes.

I used to profess myself a Buffett acolyte too. But somewhere along the line I realised I was a phoney too. I just wasn’t close to that selective and when the situation was right I wasn’t anywhere near willing enough to pull the trigger and go really large in a position.

There are psychological feedback mechanisms that stop you meeting the twenty punch-card test. Firstly it is really hard to be that patient. I did not find a new stock that met that test this year. Or last year. Or the year before. Or the year before that. I found one in 2012. And prior to that I had not found a new one since the crisis (when there were many available most of which I missed).

But I am incapable of sitting idle since 2012 (even though the local beach is very good) and so I do stuff. Inferior stuff. Stuff that may produce inferior results.

And some of it (thankfully not much) did produce inferior results. [I was long Sun Edison for example.]

And when you are wrong like that it is scarring. It makes you less willing to pull the trigger in quantity when something does meet the twenty punch-card test.Indeed perhaps the main advantage of the twenty punch card test is the avoidance of mistakes so you can (both psychologically and from a risk-management perspective) take much bigger positions when they come along.

Phoney Buffett-style value-investing is dangerous

A twenty punch card investment portfolio is – by its nature – a concentrated investment portfolio. If I had run my portfolio like that I would have come out of the crisis with maybe six stocks, turfed one or two by now and added a single stock in 2012.

The rest of the time I would have spent reading, talking to management of companies I was never going to invest in, and otherwise tried to work out how the world actually works. (And the world is always more complicated than you imagine so the work is endless even if the activity is muted.)

Many so-called Buffett acolytes (phoneys, all of them) have imbibed that a concentrated portfolio is a good idea. And so they present as having five to twelve stock portfolios and are prepared to take 30 percent positions.

But the stocks often don’t meet the twenty punch-card test. And so these investors wind up with large positions in second rate investments. When one goes wrong it is deeply painful. When three go wrong simultaneously it is devastating.

The lesson here is easily stated: “if you are going to fill your portfolio with crap, it better be diversified crap”.

Several of my favourite phoney Buffett acolytes have been posting catastrophic losses. It was due. The phoney Buffett acolytes still here are just waiting for their turn to have catastrophic losses.

Real twenty-punch-card investing is impossible to sell to clients

Just imagine if I had run a twenty-punch-card style portfolio and sold it to clients. We would have made a bunch of decision in 2008 and 2009 and our numbers would have been stunning to 2012. (Our returns on our longs were very good in those years. Way ahead of market.)

We would have turfed one or two of these. (Some businesses just change, others go up seven fold and are just not worth holding.)

I would have bought a single big position in 2012.

And since about mid-way through 2013 my cash holdings would be going up and up. Partly from dividends, partly from asset sales.

And I would be underperforming now. Quite badly, even though returns would be positive. Come to think of it, my longs mostly are underperforming now. So are the longs of many fund managers I admire.

But mostly I would have been just idle. So in the midst of underperformance a client might ask me what I did last year and I would say something like

a) I read 57 books

b) I read about 200 sets of financial accounts

c) I talked to about 70 management teams and

d) I visited Italy, the UK, Germany, France, Japan, the USA and Canada

but most importantly I did not buy a single share and I sold down a few positions I had.

And I underperformed an index fund.

That is kind of hard to justify. I don’t have a clue how you would ever sell it to clients. I can’t imagine any clients buying it.

And so to my knowledge there is absolutely nobody who is true to the formula and who really runs a concentrated 20 punch-card formula fund.

They are all phoneys because (NYSE:A) the truth is so difficult it hurts and (NYSE:B) the clients can’t handle the truth.

What I did when I realised I was a phoney Buffett acolyte

Somewhere along the line I realised that did not have the temperament to be a true 20 punch-card investor. So I did two things.

a). Rather than accumulate cash and just sit there for very long time periods (five to ten years) I tried to find shorts. The shorts have two benefits (NYSE:I) they turn into cash when the market goes down and twenty-punch-card opportunities arise and (ii) they attempt to make some money on their own.

b) I run a portfolio that is more divesified than I desire. I desire to be 15 stocks in 15 industries and seven countries, though in reality my desire should be to be more concentrated than that. [I would/should be happy with five 20 percent positions as long as they all meet the 20 punch-card test.] Alas (justified) lack of conviction means my portfolio is about 45 long positions – many of which are for sale when a better idea comes along. In other words when I hold crap at least I diversify it.

This is not entirely satisfactory. I get some longs wrong and lose money on those. And the shorts can be difficult to make money on even when you are right. A stock that goes from 10 to zero might look like a great short but if it goes via 50 then you are likely to be forced to cover some on the way up and its unlikely you will ever recover your losses.

We have strategies to manage both those problems and the results have been and will remain satisfactory although they will not always glow. There can be sustained periods of dull performance. And whist this is not as hard to sell to clients (or yourself) as a true 20 punch-card portfolio after a couple of years dull performance can become exhausting. Clients who haven’t lost any real money will leave – because there is always someone else who is making money – and the grass is always greener – and because clients see performance more than inherent risk in any portfolio – and low risk portfolios can be dull.

Portfolio managers I admire

I still admire Buffett’s portfolio management more than I can say. He really is astonishingly good at what I have chosen to do for a living.

But I can’t emulate Buffett and nor can anyone else I know. And if someone uses his name to describe their investment philosophy my (likely accurate) presumption is that they are a phoney.

There are other managers I admire. I still think Kerr Neilson at Platinum is a freak but it is awful hard to emulate him though in at least part of my portfolio I try. I worked for him for seven years and have some idea how he does it. [He is unbelievably good at cyclical stocks for instance – something Buffett professes no desire to do and which I lack some of the skills necessary to do.]

But almost every other portfolio manager I admire is a long-short manager who has come to an investing compromise like mine. They aspire to be world-class long investors but irregularly fill their portfolio with more diversified second-class stock picks. And they run short books.

And the short books hopefully make money on their own – but mostly make money at the right times – delivering their profits in down years like 2008, and stripping them of profits in super-strong markets.

The problem is that almost every one of these managers is having a dull patch at the moment. These are people I think are amongst the best in the world. And I think (without naming names) that they are having the dull patch the same way as I am. In particular it is devastatingly hard to find things that meet the 20 punch card test. [If you have one please email me. I am prepared to listen to almost anything.]

So instead they have been buying things which are “ownable” rather than “buyable”. In other words things that are sort-of-okay in that if you owned them for a decade you would probably be happy enough but not thrilled with the result. And the results from doing this have – at least over the past year – been dull. [Exception: if you bought pure bond sensitives as an alternative to bonds you did really well – but alas I did not do that…]

And the good long-short managers have found it easy to find egregious crap to short. Stuff where the story has more resemblance to fantasy than reality. The typical tell is massive differences between “the story” and the GAAP accounts”.

Some of these fantasy stocks have blown up (Valeant, Concordia) but many are alive and well and when I describe them as fantasy stocks I just get back hostility. And as a rule long “ownable”, short “fantasy” has not worked that well. Truth be told it has produced results that somewhere between 5% positive and 5% negative. It has been hard work to go nowhere.

And there are fund managers who are doing better. Some of them have tricks I do not understand (I put David Tepper in this camp – I simply don’t get how he does it and hence can’t emulate it*). But the ones I do understand I don’t like. Their chance of a plus 20 is clearly better than mine. And their chance of a minus 40 is alas even better than that, and that is something I find abhorrent even if the clients are seduced.

John

*The Tepper trade that most impressed me this cycle was long the airlines. I had enough knowledge to know this cycle would be good if I put the pieces together. But I did not put the pieces together and my allergy to capital intensive competitive businesses overwhelmed common sense. Tepper made a great trade that almost any Buffett acolyte would have ignored.

Disclosure: I am/we are long THE POSITIONS IN “THE CONTRARIAN” PORTFOLIOS.

Additional disclosure: Every investor’s situation is different. Positions can change at any time without warning. Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author’s opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including detailed review of the companies’ SEC filings. Any opinions or estimates constitute the author’s best judgment as of the date of publication, and are subject to change without notice.