Summary

- Investors are crowded into the same investment strategies, sectors, and individual equities, prodded & encouraged by central banks since the GFC.

- Almost all investors are positioned for the same outcome, which is either an eventual recession, or the lower for longer narrative prevailing.

- These anticipated certainties are why there are so many historic price dislocations today.

At the height of the prevailing bearishness in December of 2018, I was very bullish, writing privately for members of my research services, and publicly with articles such as, “Is Everyone Bearish“, and “2019 Is Going To Be A Banner Year For Value Equities“, which were both published on December 21st, 2018.

Looking back, this bullish stance was partially correct thus far, with the S&P 500 Index, as measured by the SPDR S&P 500 ETF (SPY), up 17.8% year-to-date in 2019 through April 29th, 2019, and targeted undervalued equities, like Chesapeake Energy (CHK), up 40% YTD in 2019, even after its recent pullback.

However, my bigger picture investment thesis, which has focused on the equities that are unloved, under-owned, and out-of-favor, articulated in articles like this one, “Everyone Owns The Same Stocks“, and with “Economic Growth Has Already Bottomed“, has only partially been embraced, as almost all investors expect either a recession over the next 2 years, or a continuation of the “lower for longer” narrative that currently has a python grip around the financial markets.

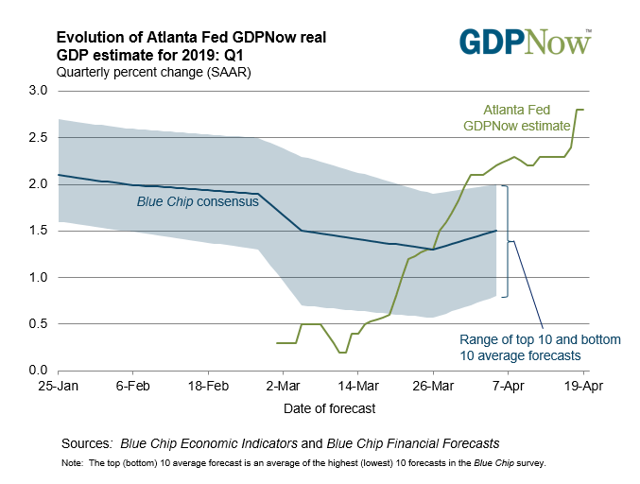

The surprise first quarter 2019 U.S. GDP reading of 3.2%, which came in far above consensus expectations, and the recent stronger economic data out of China, have done little to change the prevailing sentiment.

Put simply, almost everyone remains skeptical that any cyclical upturn in global growth expectations will have any staying power.

This sentiment, and the tendency of market participants to embrace what is working, has caused some historic price dislocations, such as the relative performance of commodities versus the S&P 500 Index.

Look at that chart above!

If you thought commodities were undervalued in the late 1990’s, the dislocation since 2011 has resulted in 100-year relative valuation levels being tested.

In summary, if you, like me, wish you could go back a decade ago in time(members of The Contrarian can read this last link), similar to Disneys’ (DIS) new Avenger’s movie, and buy the disruptive growth businesses like Amazon (AMZN), Apple (AAPL), Alphabet (GOOGL), Netflix (NFLX), even Microsoft (MSFT), and reap compounding returns that turned out to be hard to believe, I think a similar sized opportunity exists today.

This time, from my perspective, the opportunity is in economically sensitive equities, some of which own tier 1, irreplaceable assets.

Sign Up For A Limited Opportunity

I am very excited about the year ahead, and I want to recruit as many members to my investment research services as possible.

To provide incentive, I have enabled a 20% price discount on memberships to The Contrarian, (founding members still have a lower price, but this is the lowest price offered in a long time) where we have a live history that actually captured the past significant inflection point in 2016.

I am also offering a very well received more traditional research newsletter, a stepping stone to The Contrarian, featuring direct email reports, with an introductory price of $250 for the first 10 subscribers that use the coupon code “half off”, which is 50% off the current annual rate, which will rise at the end of 2019. For access to that, sign up here.

Wrapping up, looking forward, instead of looking in the rear view mirror, is very important in life, and in the investment markets.

Disclosure: I am/we are long CHK, positions in the contrarian portfolios, and short spy as a market hedge.

Additional disclosure: Every investor’s situation is different. Positions can change at any time without warning. Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author’s opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including detailed review of the companies’ SEC filings. Any opinions or estimates constitute the author’s best judgment as of the date of publication, and are subject to change without notice.