I originally wrote this Monday morning, February 24th, before the market opened here, however, I want to post here for archives.

The Signal Event Is Potentially Here

Feb. 24, 2020 7:08 AM ET|2 comments |About: SPDR S&P 500 Trust ETF (SPY), Includes: AAPL, AMZN, BAC, BAC.PA, BAC.PB, BAC.PC, BAC.PE, BAC.PK, BAC.PL, BAC.PM, BML.PG, BML.PH, BML.PJ, BML.PL, BRK.A, BRK.B, C, C.PK, C.PS, CMCSA, CPRJ, CVX, DIS, FB, GOOG, GOOGL, HD, INTC, JNJ, JPM, JPM.PC, JPM.PD, JPM.PF, JPM.PG, JPM.PH, KO, MA, MRK, MSFT, O, PEP, PG, QQQ, T, TBB, TBC, UNH, VZ, XOM

Summary

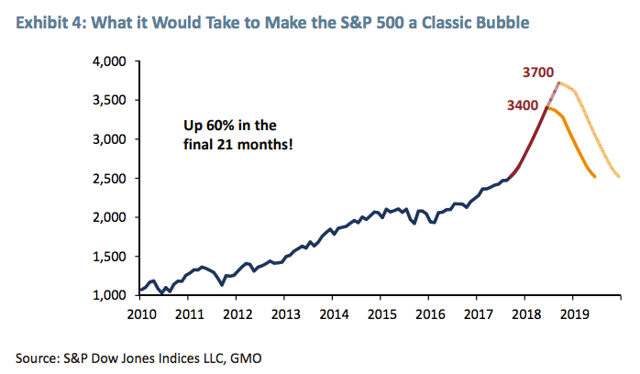

- I have been waiting for a long time for a set of events to end the virtuous melt-up, fueled by passive and ETF fund flows.

- Coronavirus could be the black swan that causes a reversal of these fund flows.

- Non-correlated equities with low index representation stand to benefit disproportionately.

Introduction

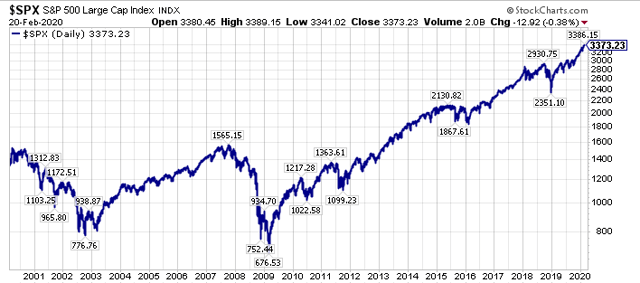

We are potentially on the verge of an historic capital rotation from growth to value, sparked by black swan catalysts that nobody envisioned a short time ago.

Building on this narrative, on February 6th, 2018, I wrote one of my most popular articles published on Seeking Alpha titled, “Be Prepared For A Crash – Part II“, and in the article, I specifically investigated the lack of price discovery in the markets, as passive, ETF, and dividend growth fund flows were largely price insensitive and valuation insensitive in their endless buying.

Today, that virtuous, seemingly never ending cycle has the potential to work in reverse fashion. In Steven Bregman’s words, all that was needed was a signal event to jump start a golden age for active investors, and we may have one transpiring in real time.

The Signal Event Could Be Happening Right Now

In a September 21st, 2017 article I authored for members of The Contrarian, titled, “Investment Philosophy – A Golden Age For Active Investors Awaits“, I pontificated on how there was very little price discovery in the market.

To illustrate this point, I referenced several quotes from Steven Bregman, president and co-founder of Horizon Kinectics, who presented at James Grant’s October 4th, 2016 Investment Conference.

Here is the first set of quotes I referenced:

“A golden age of active investment management awaits only one signal event, Steven Bregman, president and co-founder of Horizon Kinetics, told the Grant’s conference-comers on Oct. 4. A collapse of the index/ETF bubble is that intervening disaster. To hear Bregman tell it, no crash would be so well-deserved

He called the exchange-traded fund excrescence the world’s biggest bubble.

“It has distorted clearing prices in every sort of financial asset in every corner of the globe…,” asserted Bregman. “[I]t has created a massive systemic risk to which everyone who believes they are well diversified in the conventional sense are now exposed.”

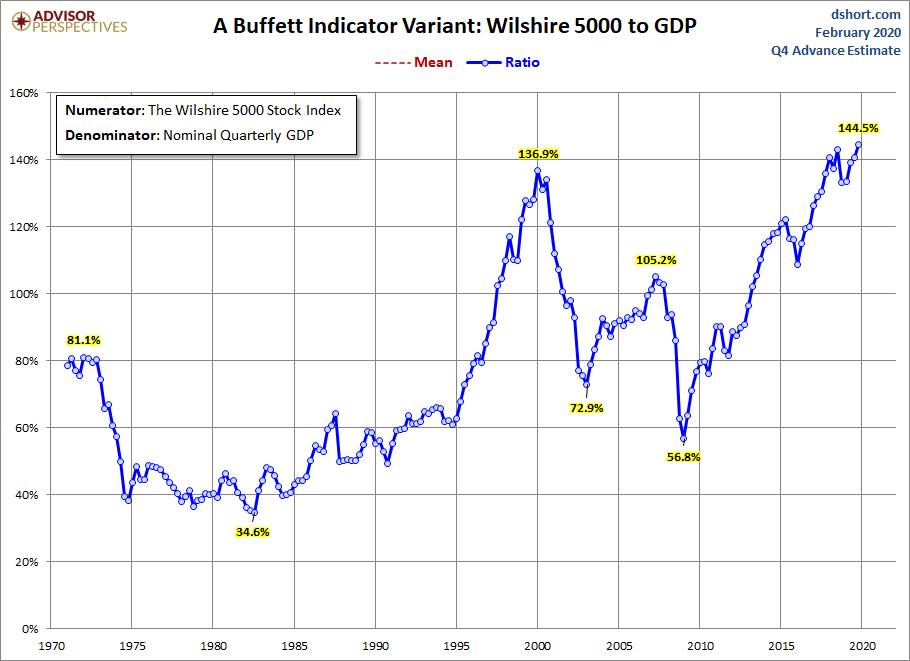

I could not agree more with the statement quoted above, and these price distortions have increased at an exponential rate from 2017-2019, and early into 2020, as crowded trades have become more crowded.

Conversely, the “Have Not” equities have been shunned to an even further degree, creating the most bifurcated market that I have seen in my 25 plus years actively investing and speculating.

A Historic Capital Rotation Is On The Horizon

Once passive, ETF, and index fund flows reverse, the disproportionately beneficiary equities, think the leading market capitalization index favorites, are going to be the equities that are hurt most by the reversal of fund flows. Conversely, out-of-favor equities that have been shunned, will actually benefit, as long/short funds reduce gross market exposure, and net buying, at least net relative buying will head to these equities.

On this note, here are the 25 largest components of the SPDR S&P 500 Index ETF (SPY), which have all been buoyed by never ending passive fund flows.

- Microsoft (MSFT) – 5.0% weighting

- Apple (AAPL) – 4.8% weighting

- Amazon (AMZN) – 3.2% weighting

- Facebook (FB) – 1.8% weighting

- Alphabet Inc. Class A (GOOGL) – 1.6 % weighting

- Alphabet Inc. Class C (GOOG) – 1.6% weighting

- Berkshire Hathaway Inc. Class B (BRK.B) – 1.6% weighting

- JPMorgan Chase & Co. (JPM) – 1.5% weighting

- Johnson & Johnson (JNJ) – 1.4% weighting

- Visa Inc. Class A (C) – 1.3% weighting

- Procter & Gamble Company (PG) – 1.1% weighting

- Mastercard Incorporated Class A (MA) – 1.1% weighting

- UnitedHealth Group Incorporated (UNH) – 1.0% weighting

- Intel Corporation (INTC) – 1.0% weighting

- Bank of America Corp (BAC) – 1.0% weighting

- AT&T Inc. (T) – 1.0% weighting

- Home Depot Inc. (HD) – 1.0% weighting

- Exxon Mobil Corporation (XOM) – 0.9% weighting

- Walt Disney Company (DIS) – 0,9% weighting

- Verizon Communications Inc. (VZ) – 0.9% weighting

- Coca-Cola Company (KO) – 0.8% weighting

- Merck & Co. Inc. (MRK) – 0.8% weighting

- Comcast Corporation Class A (CMCSA) – 0.7% weighting

- Chevron Corporation (CVX) – 0.7% weighting

- PepsiCo Inc. (PEP) – 0.7% weighting

Personally, I think the top weighted companies on this list, which dominate the S&P 500 Index, and the Invesco QQQ Trust ETF (QQQ), have a chance to sell-off dramatically, if a true capital rotation takes hold from growth to value.

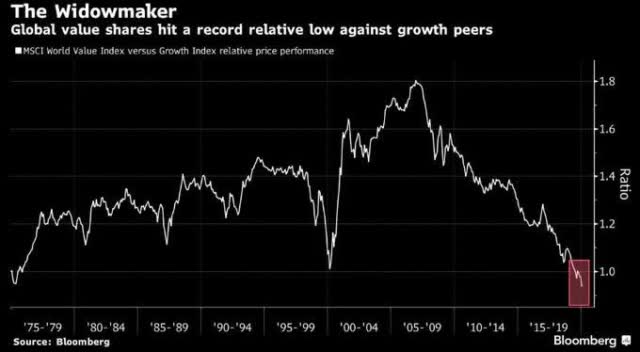

Given the current extended levels of growth versus value, there is a ripe opportunity for an epic price reversal.

Looking at the above, look how steep the price reversal was in 2000-2002, with the growth to value relationship reversing on a dime, and moving straight in the other direction.

Could the same thing happen today?

Yes, is my unequivocal answer, partly because the in-favor investment strategies and trades, think passive, ETF, and dividend growth fund flows, are even more popular today on a relative basis than they were in the late 1990’s, as almost every registered investment advisor in the U.S. has shifted to some form of passive indexing.

Wrapping up, coming from a value investment background, I have seen many of my peers ground to dust, and legendary value investors essentially take their ball and go home. Personally, I have more significant scars from this time frame than any other.

The collective price action and collective investor response is very reminiscent of Julian Robertson closing his Tiger Funds near the exact peak of the 1990-2000 bubble, an investment landscape that had seen Warren Buffett routinely criticized. Of course, this was followed by a massive reversion-to-the-mean trade from 2000-2002, and really 2000-2007, where value investing handily outperformed.

Building on this narrative, during 2000-2002, the S&P 500 Index lost roughly 50% from peak-to-trough, while many value stocks, including REITs, like Realty Income (O), which was loathed at the time, but loved today after roughly two decades of out-performance, surged higher, even with the broader market struggling mightily.

With that last thought in mind, consider what investments are loathed, and loved, today.

In closing, for the value investors that are left today, the odds seem insurmountable, however, the opportunities, particularly on a relative basis, are as big as they have ever been.

To get an idea of how I am positioning for this opportunity, since we are past there, in my opinion, I am offering a 20% discount to membership (I am extending this through February) to “The Contrarian” (past members can also direct message me for a special rate), the lowest price point since the founding members price, where we have a live documented history dating back to late 2015..

Additionally, I am offering a limited time 40% discount for the first 5 new members, repeating a successful promotion from earlier this month (I expect these slots, some of which I view as a stepping stone to “The Contrarian”, to fill up fast as they have done previously) to a host of research options, including a lower price point. To get this offer, go here, and enter coupon code “february 2020” without the quotes.

Reach out with any questions via direct message.

Via my research services, or another avenue, please do your due diligence, and take advantage of what I believe is a historic inflection point,

WTK

P.S. Resilience is perhaps the most important ingredient to be successful in life, and in the markets. Keep that in mind right now.

Disclosure: I am/we are long BAC, C, xom, and short AAPL via put options and spy in a long/short portfolio.

Additional disclosure: Every investor’s situation is different. Positions can change at any time without warning. Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author’s opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including detailed review of the companies’ SEC filings. Any opinions or estimates constitute the author’s best judgment as of the date of publication, and are subject to change without notice.