(Travis’s Note: I originally wrote this full post on February 2nd, 2017, and I wanted to use/emphasize this excerpt as a reminder of the difficulties that value investors have to endure to see a thesis out).

This correction has been trying on investor’s patience, and it reminded me of a paraphrased quote from an article by Charlie Bilello that our esteemed Contrarian Member from New Zealand, “Motu”, provided a link to earlier in “Live Chat”, essentially saying that, “to be a good investor; you have to be good at suffering”.

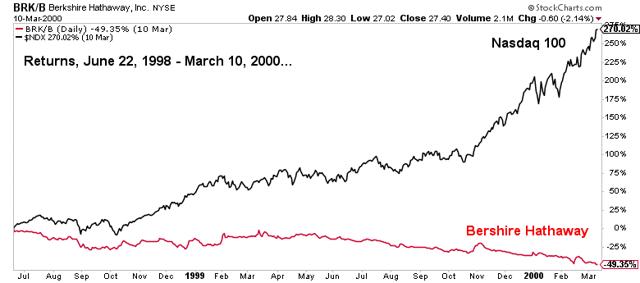

In the article, Bilello referenced the famous under-performance of Berkshire Hathaway (NYSE:BRK.A), (NYSE:BRK.B), whose shares declined roughly 50% from June of 1998 to March of 2000, while the Nasdaq 100 rose 270%. Here is the chart of Berkshire’s under-performance, replicated from the article, over that time-frame.

I was an active market participant during this time frame, and made a small fortune from 1995-1999, but as a value investor, I have my painful war stories from this era, which hurt many legendary value oriented investors, including Buffett, Grantham, whose firm GMO lost roughly two-thirds of their clients, and Julian Robertson, who closed his famous Tiger Fund.

My personal learning experience from the late 1990’s including shorting stocks like Intraware and Digital Island too early (November of 1999), and missing out on the downside, while losing significantly, as these aforementioned stocks, and others, doubled in mere days, sometimes in a single day, before ultimately crashing to nothing. This was a painful experience to participate in, and learn from, as my research analysis proved to be right, but my timing and implementation proved to be wrong.

Ultimately, value stocks, particularly small-cap value stocks, and REITs (which ironically are overvalued today), significantly outperformed in the ensuing 2000-2002 bear market. Not surprisingly, Buffett materially outperformed, recapturing the performance gap, and enhancing his already considerable reputation as a legendary value investor.

Wrapping up this opening missive, as a veteran, contrarian, value investor, I can attest to the veracity of the statement that to outperform, you must be good at suffering.

While the most difficult suffering, in my opinion, is waiting for the inflection point in a market, particularly if you are early, there also can be significant suffering once the turn arrives, and a bull market is in bloom.

Building on this narrative, ironically, some of the worst suffering happens during pullbacks in bull markets, as the bull markets want to throw investors off the market, and out of their positions.

Fortunately, bull markets have a way of resolving to the upside after they try to throw the most investors they can off the bull market.