(Travis’s Note: This post was originally written on March 8th, 2018, and I encourage readers to go to the original post to view the comments. The central theme of this article, which essentially boils down to buying-and-holding compounding equities, is a central theme of mine, from an investment philosophy standpoint. Additionally, as part of the discussion, I talk about the “Punch Card Portfolio” in this post, and you will see multiple references to that in reading my research. One last thing, the ground floor of the future sector that I think will thrive is commodity equities, specifically natural gas equities, and more specifically Appalachia natural gas producers, which members of WTKTheContrarian have already received one-deep dive report on Southwestern Energy (SWN), which I believe is the best-buy-and-hold stock in the U.S. market today, with more reports on these companies, and this sector, to be delivered in the future.)

- Buying and holding quality stocks is a surefire path to investment success.

- This is harder to do in practice than in theory.

- Ground floor of a future sector that I believe will thrive.

Wednesday night, and Thursday morning, I worked on, and published, an article for members of The Contrarian that highlighted, what I believe, is one of the brightest future long-term growth opportunities in the United States.

As I was wrapping up this article, and the revisions to the article, it occurred to me, that the best way to participate in this sector is just to buy and hold a select group of companies for the foreseeable future.

Building on this narrative, we all look at the Dividend Champions or Dividend Aristocrats of today, and wish that we could have gone back in time and “bought in” on the ground floor of these company’s eventual successes, like eponymous Seeking Alpha author Buyandhold 2012, who is one of my favorite investors & commentators in SA’s community, and who many investors, including myself, at the tender age of 40, could learn from.

Aside from both being paper boys in our youth (do they even have paper routes for kids today?), our investment paths been very different, and I have learned (often the hard way) that buying and holding quality companies is the best way to get the most out of your investments.

In fact, the more I think about it, there is a compelling case that can be made for buying, and never selling, as this would make investors think about their investments in a different light, and ease the burden of what to do, and when to do it.

Buffett commented about this investment approach, and had a name for it, which he called the “Punch Card” Portfolio, meaning that if you had a punch card, and could only make 20 investments in your life, and that was it, it would make most investors better investors.

Think about that for a minute, as I am sure almost all of us as investors would have run through our 20 “Punches”, as the electronic world of investing is conducive to over trading, and over analysis.

I wrote about the “Punch Card” Portfolio, and John Hempton’s take on this type of Portfolio in an October 20th, 2016 article for members. If you are a member of The Contrarian, click on the above link, and it will take you to this article.

Looking back, most of my biggest investment mistakes in life have involved selling companies too early, as there is no limit to how much a quality company can compound wealth, given time.

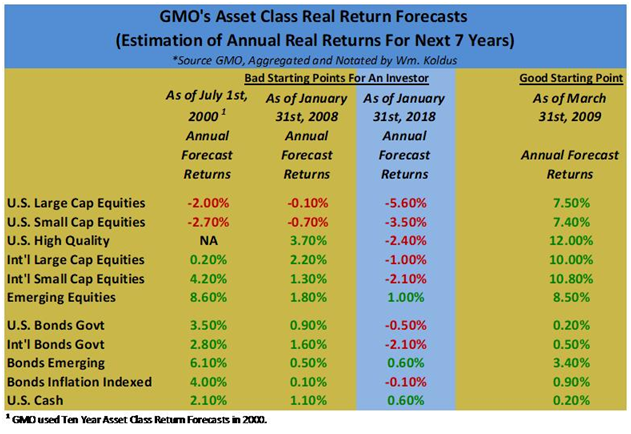

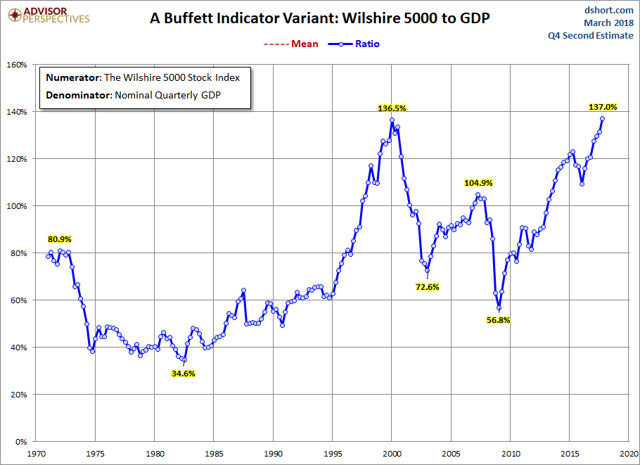

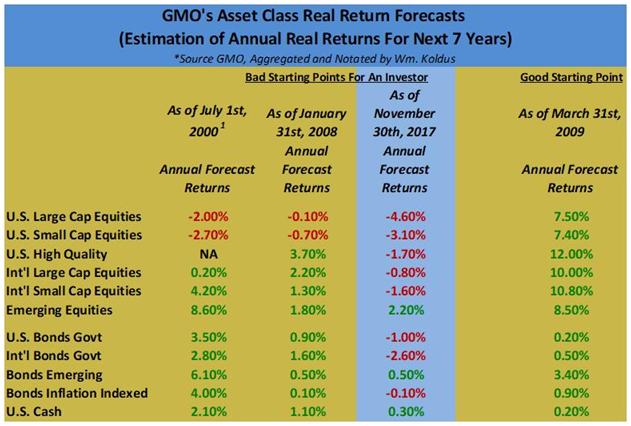

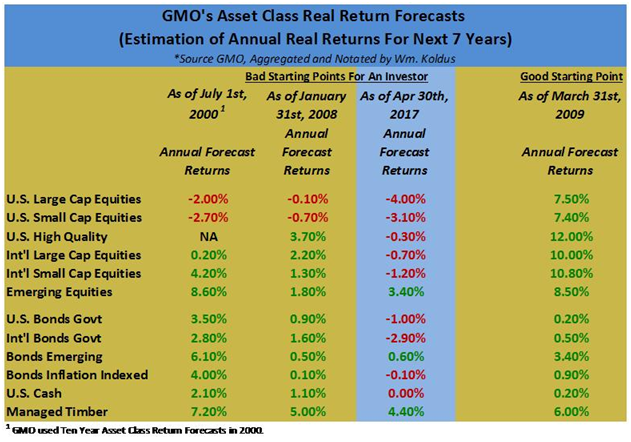

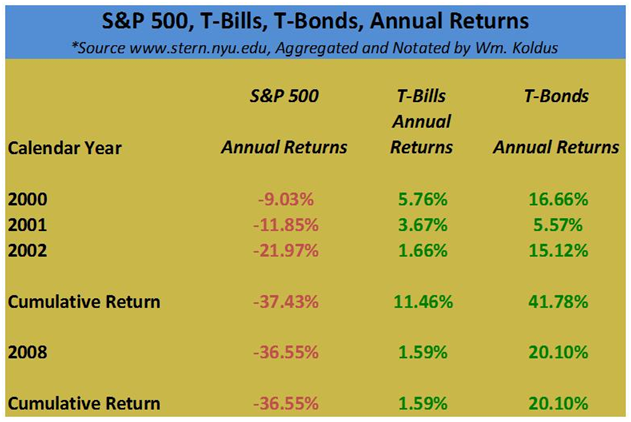

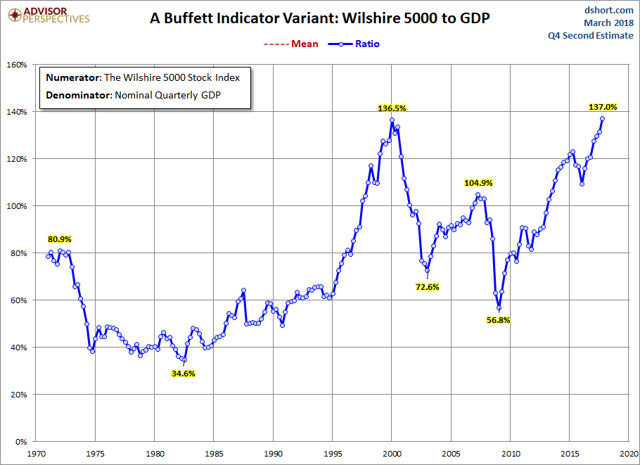

The problem today, is that almost everything is overpriced, including many of the stalwart companies in the in S&P 500 Index (SPY), and many of the Dow Jones Industrial (DIA) components, so it is hard to find a quality company that is attractively priced.

This leaves an investor with two primary choices, including building cash to wait for future opportunities, and spending time looking for undervalued companies in out-of-favor sectors.

Instead of purchasing the broader stock market at all-time valuation highs, would it not be much better to buy a sector, or a group of companies, that was selling at multi-decade lows in terms of valuations?

Do these type of companies even exist in today’s hyper valued stock market?

Said another way, are there any “Punch Card” investment opportunities today?

The answer is a resounding yes.

To find them, though, as an investor, you have to look forward, not backward, and this is hard to do too, as almost all of us want to extrapolate the past into the future.

This is human nature, and it causes us to miss opportunities as the investment markets are non-linear in structure.

What if I said that there is a group of companies as undervalued as the best opportunities at 2009’s market bottom hiding in plain sight, with the wind at their back for the foreseeable future?

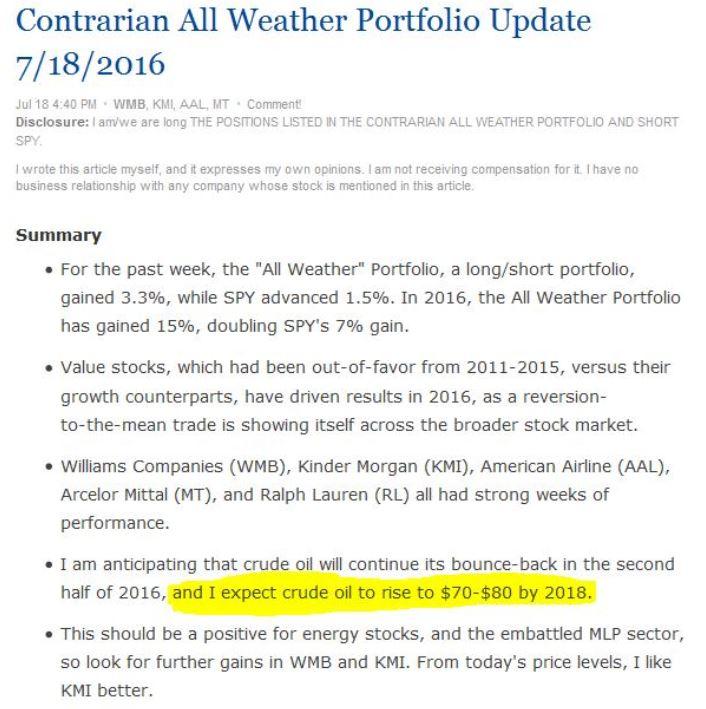

Clearly this does not describe the broader stock market today, but there are a group of company’s, much like REITs, or small-cap equities in 2000, that are extremely out-of-favor, while the market is extremely in-favor.

Would it help to know that these companies are profitable today, even at the bottom of a nearly decade long bear market in their industry, and just beginning to pay dividends and return cash flow to shareholders?

Would it help to know that these companies own emerging Tier 1 assets in a world that has largely already been discovered and owned?

Over the next several months, I am going to write several public articles on these companies to get commentary and feedback from fellow investors.

For now though, particularly over the next several weeks, I am going to double my efforts for members of The Contrarian, as after a lot of blood, sweat, and tears, I am increasingly coming to the realization that a huge opportunity is right in front of us as investors.

To read my recent article and get a preview of what I think could be long-term quality companies early in their life-cycle, in an emerging out-of-favor sector, consider taking a two-week free trial to “The Contrarian“.

If it is not for you, there are no hurt feelings.

I am willing to face rejections, as I try to put together a unique group of investors, traders, and speculators.

In fact, we would welcome a few qualified dissenters to the group to take the other side of the thesis, and to flush out these investment ideas further, so if that could be your role, send me a message and I will respond.

Best of luck to everybody, and have an enjoyable end to the week,

WTK

P.S. If you have a “Punch Card” stock idea today, meaning a stock that you would buy and hold forever, share it in the comments section, and we could probably get a good discussion going.

Disclosure: I am/we are short SPY In A Hedged Portfolio..

Additional disclosure: Every investor’s situation is different. Positions can change at any time without warning. Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author’s opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including detailed review of the companies’ SEC filings. Any opinions or estimates constitute the author’s best judgment as of the date of publication, and are subject to change without notice.