Conviction, engagement, and capital are important. Also, position sizing matters immensely. When you have a “fat pitch”, bet big, or said another way, bet the farm.

Author’s Highlighted Posts – Punch Card Portfolio – A Take From John Hempton @ Bronte Capital

(Travis’s Note: This article was originally published on October 20th, 2016, and is being republished on October 28th, 2018. The article highlights the Punch Card Portfolio Concept, originally derived from Buffett, which we talked about earlier this evening with the re-post of the Buy & Hold article, and this will be a regular topic going forward. Thus, this is a foundational article for members, in my opinion.)

- A look at John Hempton’s view on portfolio strategy and construction.

- What is the 20 punch card portfolio?

- Why is a long/short portfolio important as a core, which then can be surrounded by concentrated satellite portfolios?

In my reading, I have come to appreciate the musings of John Hempton, who runs Bronte Capital. The following piece has several nuggets of wisdom, including John’s take on Warren Buffett’s punch card approach to investing, which would limit the number of investments you could make in your lifetime to 20. Once these “punch cards” were used up, you would be out of investment choices. This would emphasize the importance of investment selection, not overtrading, and sitting on your hands, which has become one of my favorite investment expressions.

When thinking through my investment career, looking back through the rear view mirror over the past twenty plus years, I can see mistakes I made by overtrading and these were often, some of the costliest mistakes, as I bought attractive investments and then sold them too early. These so called mistakes often ended up being good, or great investments, but they were not the phenomenal returns that really impact portfolio returns and that could have been achieved by buying and holding these undervalued, contrarian opportunities.

Building on that narrative of the 20 punch card investment philosophy, if we could only make 20 investments starting today, which stocks would we buy? Are there any extraordinary candidates today, like Macquarie Infrastructure (NYSE:MIC) was in the spring of 2009? I have some ideas that I will share in the commentary section of the discussion. For now, enjoy John’s view on the topic, his take on portfolio construction, and his evolution as an investor, which has many parallels to “The Contrarian” Portfolios, including the importance of a long/short portfolio, which in our world is the Contrarian “All Weather” Portfolio.

Travis

P.S. Remember the importance of being patient and sitting on your hands! We have seen that lately in our investments.

Comments on investment philosophy – part one of hopefully a few…

This is the first of several investment think pieces I have in my head dealing with investment philosophy, where markets are now and maybe even a stock or two… They are surprisingly hard to write so these posts might come slowly…

—

When I was starting out in the investment game I read Warren Buffett’s letters from inception, Ben Graham, Phil Fisher, anything I could on Charlie Munger and the rest of the standard investing canon.

One thing that had a profound effect on me was Warren Buffett’s twenty punch card. ( Quoted here…)

Buffett has often said, “I could improve your ultimate financial welfare by giving you a ticket with only twenty slots in it so that you had twenty punches – representing all the investments that you got to make in a lifetime. And once you’d punched through the card, you couldn’t make any more investments at all. Under those rules, you’d really think carefully about what you did, and you’d be forced to load up on what you’d really thought about. So you’d do so much better.”

Buffett is right. That would be a really good way to run your private investments – you would, I think, be very rich by the time you were old. And indeed Charlie Munger has run his career close to that way (though I suspect he is closer to 100 investments by now…)

Charlie Munger has quoted Blaise Pascal approvingly: “all of humanity’s problems stem from man’s inability to sit quietly in a room alone.

There are plenty of people out there who call themselves Buffett acolytes – and as far as I can see they are all phoneys. Every last one of them.

Find any investor who models themselves off Warren Buffett and look at what they do.

And look at their investments against a twenty punch card test.

They fail. They don’t even come close. Several big-name so-called Buffett acolytes have made more than three to five large investments in the last three years and at prices that can’t possibly meet the twenty punch card test. Most phoney Buffett acolytes have been turning stock over faster than that.

Warren Buffett’s two juniors (Todd Combs and Ted Weschler) have turned over many stocks in the past few years too – and at prices that don’t reconcile with any twenty-punch-card philosophy. They are phoneys too. Just a little less egregious than many other so-called Buffett acolytes.

I used to profess myself a Buffett acolyte too. But somewhere along the line I realised I was a phoney too. I just wasn’t close to that selective and when the situation was right I wasn’t anywhere near willing enough to pull the trigger and go really large in a position.

There are psychological feedback mechanisms that stop you meeting the twenty punch-card test. Firstly it is really hard to be that patient. I did not find a new stock that met that test this year. Or last year. Or the year before. Or the year before that. I found one in 2012. And prior to that I had not found a new one since the crisis (when there were many available most of which I missed).

But I am incapable of sitting idle since 2012 (even though the local beach is very good) and so I do stuff. Inferior stuff. Stuff that may produce inferior results.

And some of it (thankfully not much) did produce inferior results. [I was long Sun Edison for example.]

And when you are wrong like that it is scarring. It makes you less willing to pull the trigger in quantity when something does meet the twenty punch-card test.Indeed perhaps the main advantage of the twenty punch card test is the avoidance of mistakes so you can (both psychologically and from a risk-management perspective) take much bigger positions when they come along.

Phoney Buffett-style value-investing is dangerous

A twenty punch card investment portfolio is – by its nature – a concentrated investment portfolio. If I had run my portfolio like that I would have come out of the crisis with maybe six stocks, turfed one or two by now and added a single stock in 2012.

The rest of the time I would have spent reading, talking to management of companies I was never going to invest in, and otherwise tried to work out how the world actually works. (And the world is always more complicated than you imagine so the work is endless even if the activity is muted.)

Many so-called Buffett acolytes (phoneys, all of them) have imbibed that a concentrated portfolio is a good idea. And so they present as having five to twelve stock portfolios and are prepared to take 30 percent positions.

But the stocks often don’t meet the twenty punch-card test. And so these investors wind up with large positions in second rate investments. When one goes wrong it is deeply painful. When three go wrong simultaneously it is devastating.

The lesson here is easily stated: “if you are going to fill your portfolio with crap, it better be diversified crap”.

Several of my favourite phoney Buffett acolytes have been posting catastrophic losses. It was due. The phoney Buffett acolytes still here are just waiting for their turn to have catastrophic losses.

Real twenty-punch-card investing is impossible to sell to clients

Just imagine if I had run a twenty-punch-card style portfolio and sold it to clients. We would have made a bunch of decision in 2008 and 2009 and our numbers would have been stunning to 2012. (Our returns on our longs were very good in those years. Way ahead of market.)

We would have turfed one or two of these. (Some businesses just change, others go up seven fold and are just not worth holding.)

I would have bought a single big position in 2012.

And since about mid-way through 2013 my cash holdings would be going up and up. Partly from dividends, partly from asset sales.

And I would be underperforming now. Quite badly, even though returns would be positive. Come to think of it, my longs mostly are underperforming now. So are the longs of many fund managers I admire.

But mostly I would have been just idle. So in the midst of underperformance a client might ask me what I did last year and I would say something like

a) I read 57 books

b) I read about 200 sets of financial accounts

c) I talked to about 70 management teams and

d) I visited Italy, the UK, Germany, France, Japan, the USA and Canada

but most importantly I did not buy a single share and I sold down a few positions I had.

And I underperformed an index fund.

That is kind of hard to justify. I don’t have a clue how you would ever sell it to clients. I can’t imagine any clients buying it.

And so to my knowledge there is absolutely nobody who is true to the formula and who really runs a concentrated 20 punch-card formula fund.

They are all phoneys because (NYSE:A) the truth is so difficult it hurts and (NYSE:B) the clients can’t handle the truth.

What I did when I realised I was a phoney Buffett acolyte

Somewhere along the line I realised that did not have the temperament to be a true 20 punch-card investor. So I did two things.

a). Rather than accumulate cash and just sit there for very long time periods (five to ten years) I tried to find shorts. The shorts have two benefits (NYSE:I) they turn into cash when the market goes down and twenty-punch-card opportunities arise and (ii) they attempt to make some money on their own.

b) I run a portfolio that is more divesified than I desire. I desire to be 15 stocks in 15 industries and seven countries, though in reality my desire should be to be more concentrated than that. [I would/should be happy with five 20 percent positions as long as they all meet the 20 punch-card test.] Alas (justified) lack of conviction means my portfolio is about 45 long positions – many of which are for sale when a better idea comes along. In other words when I hold crap at least I diversify it.

This is not entirely satisfactory. I get some longs wrong and lose money on those. And the shorts can be difficult to make money on even when you are right. A stock that goes from 10 to zero might look like a great short but if it goes via 50 then you are likely to be forced to cover some on the way up and its unlikely you will ever recover your losses.

We have strategies to manage both those problems and the results have been and will remain satisfactory although they will not always glow. There can be sustained periods of dull performance. And whist this is not as hard to sell to clients (or yourself) as a true 20 punch-card portfolio after a couple of years dull performance can become exhausting. Clients who haven’t lost any real money will leave – because there is always someone else who is making money – and the grass is always greener – and because clients see performance more than inherent risk in any portfolio – and low risk portfolios can be dull.

Portfolio managers I admire

I still admire Buffett’s portfolio management more than I can say. He really is astonishingly good at what I have chosen to do for a living.

But I can’t emulate Buffett and nor can anyone else I know. And if someone uses his name to describe their investment philosophy my (likely accurate) presumption is that they are a phoney.

There are other managers I admire. I still think Kerr Neilson at Platinum is a freak but it is awful hard to emulate him though in at least part of my portfolio I try. I worked for him for seven years and have some idea how he does it. [He is unbelievably good at cyclical stocks for instance – something Buffett professes no desire to do and which I lack some of the skills necessary to do.]

But almost every other portfolio manager I admire is a long-short manager who has come to an investing compromise like mine. They aspire to be world-class long investors but irregularly fill their portfolio with more diversified second-class stock picks. And they run short books.

And the short books hopefully make money on their own – but mostly make money at the right times – delivering their profits in down years like 2008, and stripping them of profits in super-strong markets.

The problem is that almost every one of these managers is having a dull patch at the moment. These are people I think are amongst the best in the world. And I think (without naming names) that they are having the dull patch the same way as I am. In particular it is devastatingly hard to find things that meet the 20 punch card test. [If you have one please email me. I am prepared to listen to almost anything.]

So instead they have been buying things which are “ownable” rather than “buyable”. In other words things that are sort-of-okay in that if you owned them for a decade you would probably be happy enough but not thrilled with the result. And the results from doing this have – at least over the past year – been dull. [Exception: if you bought pure bond sensitives as an alternative to bonds you did really well – but alas I did not do that…]

And the good long-short managers have found it easy to find egregious crap to short. Stuff where the story has more resemblance to fantasy than reality. The typical tell is massive differences between “the story” and the GAAP accounts”.

Some of these fantasy stocks have blown up (Valeant, Concordia) but many are alive and well and when I describe them as fantasy stocks I just get back hostility. And as a rule long “ownable”, short “fantasy” has not worked that well. Truth be told it has produced results that somewhere between 5% positive and 5% negative. It has been hard work to go nowhere.

And there are fund managers who are doing better. Some of them have tricks I do not understand (I put David Tepper in this camp – I simply don’t get how he does it and hence can’t emulate it*). But the ones I do understand I don’t like. Their chance of a plus 20 is clearly better than mine. And their chance of a minus 40 is alas even better than that, and that is something I find abhorrent even if the clients are seduced.

John

*The Tepper trade that most impressed me this cycle was long the airlines. I had enough knowledge to know this cycle would be good if I put the pieces together. But I did not put the pieces together and my allergy to capital intensive competitive businesses overwhelmed common sense. Tepper made a great trade that almost any Buffett acolyte would have ignored.

Disclosure: I am/we are long THE POSITIONS IN “THE CONTRARIAN” PORTFOLIOS.

Additional disclosure: Every investor’s situation is different. Positions can change at any time without warning. Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author’s opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including detailed review of the companies’ SEC filings. Any opinions or estimates constitute the author’s best judgment as of the date of publication, and are subject to change without notice.

Long/Short Investing

(Travis’s Note: This article was originally published on July 16th, 2017, and it is being re-posted today, October 28th, 2018, to organize for the archives. Long/short has had a very difficult past decade, but I believe it is primed for a very good decade ahead).

The past several days, I have been working on an article for members of “The Contrarian”, that reviews a generational hedge fund call from 2013, and why this call remains relevant today.

In going through my archived writings, I came across an article I wrote on long/short investing in January of 2016, and I wanted to highlight a portion of that article, specifically my comments on long/short investing.

Here is the excerpt from the January 2016 article:

Reflection On My Long/Short Investment Philosophy

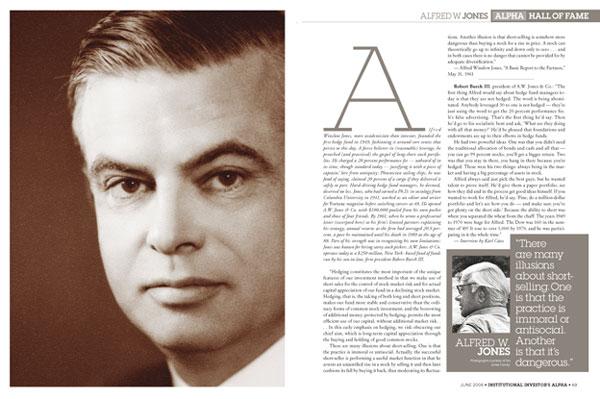

Ever since I learned about Alfred Winslow Jones, the pioneer of hedge fund investing, I was fascinated by the long/short investment strategy. Ideally, it performed well in up- and down-market environments, and separated stock picking skill from general market movements.

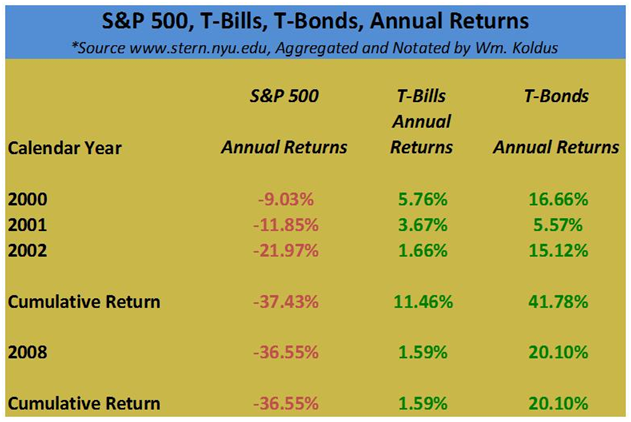

During my early career as an investment analyst, I focused on value-oriented investment managers and their philosophies. Some of my favorite investment managers were Mason Hawkins, Marty Whitman, Bob Rodriguez, Dan Fuss, and Jean-Marie Eveillard. Reading their analysis and following their investment strategies influenced and shaped my thinking. The 2000-2002 time frame reinforced my value leaning, as value managers, especially the aforementioned ones, strongly outperformed, as the S&P 500 Index declined nearly 40%.

In contrast to 2000-2002, the dramatic downturn of 2008 treated value investors far differently. Many value investors piled into financial stocks as they declined, attracted by the relatively and historically cheap valuations. Trying to buy value investments in 2008 was akin to catching a falling knife, similar to buying commodity stocks over the last three years (Author’s Updated Note: commodity stocks had a historic reversal and rebound in 2016), and many value-oriented investment investors and firms went out of business.

The tremendous volatility of 2008 also negatively impacted long/short equity hedge fund managers. From my perspective covering hedge fund managers at the time, many long/short portfolios experienced historic volatility and drawdowns, especially in the second half of 2008, particularly in the months of October and November. Observing how these managers responded, reducing gross and net exposure, and emphasizing their highest conviction investments, was an invaluable learning experience.

During 2008/2009, I kept my eyes fixated upon the performance of a select few hedge fund managers. One firm that I followed closely for personal and business reasons was Lee Ainslie’s Maverick Capital. Lee Ainslie, one of my favorite investors, is a descendant in the lineage of the legendary Julian Robertson (another one of my favorite investors), and he sparked my curiosity with how his team structured Maverick’s portfolios. Maverick was founded in 1990, and since inception, it has focused on long/short equity investing, eschewing macro, currency, and interest rates bets.

Part of my attraction to Maverick’s investment philosophy was that it was different from my own investment philosophy. Personally, I have always liked macro forecasts and the trading and investing opportunities that they inspire. My strong 2008 and 2009 performance years were largely the result of my macro market views. Because of their love for macro investing, I have been drawn to investors like Stanley Druckenmiller or John Burbank of Passport Capital, and they have heavily influenced my investment philosophy.

To summarize, value investing, long/short investing, macro calls, and a general contrarian stance have all become critical components of my personal investment philosophy. The struggles I have endured trying to buy historically cheap commodity stocks over the last several years has scared me, and caused me to at least consider a worst-case scenario more than I did prior to this experience (Author’s Updated Note: It has also caused me to heavily research the capital cycle, and members of The Contrarian will know what I am referring to specifically).

The resulting compilation of investment philosophies has been mashed together to produce the Contrarian All Weather Portfolio, my version of a long/short portfolio (Author’s Updated Note: This portfolio has has material out-performance since its December 7th, 2015 inception despite the robust performance in the U.S. stock market). At its heart, stock-picking results, netted out by a SPDR S&P 500 ETF (SPY) hedged position, will drive the returns of the portfolio. A majority of the individual stock selections are value oriented in some fashion. Additionally, there will be a macro theme to the portfolio alongside some macro positioning at the margin.

Takeaway: Long/Short Investing Is More Timely Today

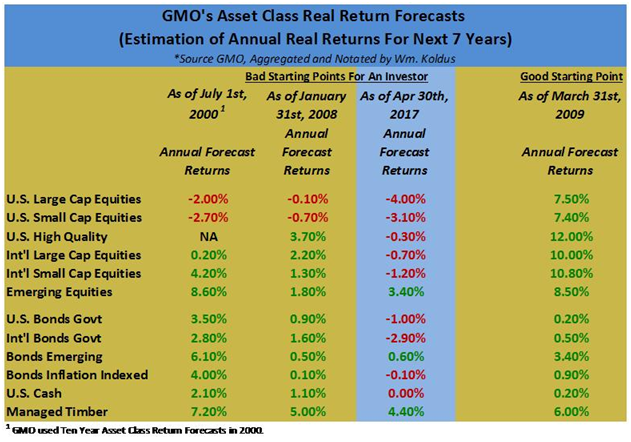

Similar to the late 1990’s, which culminated in a period where growth outperformed value for roughly ten years, the past decade has also seen growth outperform value ironically from 2008 through today, in an environment where stock and bond valuations have become historically extended.

The end result is that expected future real returns today, for both stocks and bonds, are some of the lowest projected real returns in history.

Additionally, with bond yields low in nominal terms, the next significant market correction in U.S. equities, will not see investors saved by bond out-performance, in my opinion.

To close, there is a high probability that a traditional “60/40” equity/bond portfolio or “70/30” equity/bond portfolio will have negative real returns over the next decade. All investors should think about today’s starting valuations when constructing their portfolios.

William “Travis” Koldus

Disclosure: I am/we are short SPY.

Additional disclosure: SPY short is a hedge position to offset long investments in a long/short portfolio. Every investor’s situation is different. Positions can change at any time without warning. Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author’s opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including detailed review of the companies’ SEC filings. Any opinions or estimates constitute the author’s best judgment as of the date of publication, and are subject to change without notice.

Author’s Highlighted Posts – A Golden Age For Active Investors

- Passive investing, and ETF investing, have dominated the last decade.

- These unsustainable investing trends have created giant price distortions.

- The next decade will be extremely lucrative for active investors and we are at an inflection point today.

(Travis’s Opening Note: This article was originally authored and published on September 21st, 2017, and it remains a “foundation article”, in my opinion, for my current investment stance, and it one of my favorite articles that I have authored. It is being republished today, on 10/23/2018, to launch a new series category, which will be titled “Author’s Highlighted Posts”.)

“A 60:40 allocation to passive long-only equities and bonds has been a great proposition for the last 35 years,” …”We are profoundly worried that this could be a risky allocation over the next 10.”

Sanford C. Bernstein & Company Analysts (January 2017)

“Be stubborn on vision and flexible on journey”

Noramay Cadena

Life and investing are long ballgames.”

Julian Robertson

Opening Note From WTK

When I worked at Oxford Financial Group, Limited, which was, and remains one of the largest RIA’s in the United States, I was hired by the CIO, Howard Harpster, who was the former head of BP Amoco’s (BP) pension plan. Howard was an intelligent, calculated risk-taker who cultivated relationships in the then opaque, and relationship-based, private equity, private real estate, and hedge fund arenas.

Howard eventually returned to his native Texas, which is near and dear to my heart, as I have many close relatives and friends in Texas, to sort through a family estate, and then take the role of CIO at the Texas Children’s Hospital.

Oxford conducted an executive search, on which I served a role, and narrowed the candidates for CIO to two individuals, ultimately hiring their current CIO in roughly late 2006 or early 2007.

The new CIO, who came from a background at Okabena, which was the family office created by the founding family of Target (TGT), embraced passive investing.

This firmly contrasted with my belief that the markets were not efficient, and we had a rousing discussion and debate for several years, both between the CIO and our broader investment strategy group, which was composed of four key decision makers, including myself, before I ultimately resigned, with good relationships in-tact, to start my investment firm in February of 2009.

At the time, I was full of confidence, as I had made money in 2008, when most investors and speculators lost money, and then I procured a small fortune, at least for me, from timely investments made in 2008 & 2009.

In the middle of 2008 and 2009, I thought it was a dream environment for active investors, and I could not see how the passive investment craze, that characterized the market’s rise from 2003-2007 could continue.

I was spectacularly wrong with this prediction.

Passive investing has dominated the past decade, making the shift to passive investments from 2003-2007 look like a blip on a long-term chart.

This has driven many active managers out of the investment industry (Travis’s Updated Note 10/23/2018: This purge has continued into 2018), accelerating the dispersion between passive investors and value investors, which has resulted in hedge fund closures, the decline of once prominent mutual fund families, and the downgrade in reputation to value investing and value investors.

This seemingly never ending, self-reinforcing, investment cycle has resulted in a bi-furcated market, where the favored investments of passive indexes, dividend growth strategies, and popular ETF’s are traded at some of the highest valuations in history, while equities outside these favored strategies trade at some of the lowest valuations in history.

In summary, this has created another dream environment for active investors, which is even better than 2008-2009 time-frame, in my opinion, and a golden age of active investing is right in front of investors and speculators, in my opinion.

We got a taste of this opportunity in 2016, but the market has not made the pendulum shift from passive investing being in-favor to active value investing being in-favor easy. In fact, 2017 has been one of the most difficult, if not the most difficult years, of my investment career, thus far, but that should not take away from the scope, or magnitude, of the opportunity that is at hand.

Someday in the near-future, it is my prediction that investors will rue the fact that their equities are part of the benchmark indexes, and popular ETF strategies. Thus, we sit on the cusp of a historic inflection point. On this note, I came across a past issue of Grant’s Interest Rate Observer, from last October, about a week ago, that reinforced this point, and I wanted to write something about it, so here is that observation as part of my Investment Philosophy series.

Selected Prior Member Articles Of Interest On Investment Philosophy & Related Topics

Selected prior articles of interest for members on investment philosophy, market history, and portfolio strategy include:

Investing Philosophy – Abandoning Ship & Capitulation – 8/3/2017

Investment Philosophy – Identifying A Good Opportunity Is Only Half The Battle – 7/16/2017

Investing Philosophy – Staying Focused Is Hard To Do – 5/27/2017

Market Historian – What Happens When The Fed Raises Rates – 3/16/2017

Investment Philosophy – The Fallacy That You Always Need To Be Fully Invested – 2/2/2017

A Matter Of Perspective – Commodities & Commodity Stocks – 1/6/2017

Interview Series – Part II Of WTK’s Take On Edward Chancellor’s View With A Focus On Precious Metal Equities – 12/15/2016

Interview Series – WTK’s Take On Edward Chancellor’s View On “Intelligent Contrarian Investing” – 11/21/2016

Investment Philosophy For The Contrarian Subscribers – A Take From John Hempton @ Bronte Capital – 10/20/2016

The Contrarian’s Top-Ten Lists & Thoughts On Portfolio Strategy – 9/29/2016

Reviewing Lucas White’s And Jeremey Grantham’s Research On Commodity Stocks & A Market Note From WTK – 9/9/2016

Working Investment Thesis

It is my belief that we are in the final innings of the bull market that began in March of 2009, with bonds topping now, then stocks, and then commodities.

The Inspiration

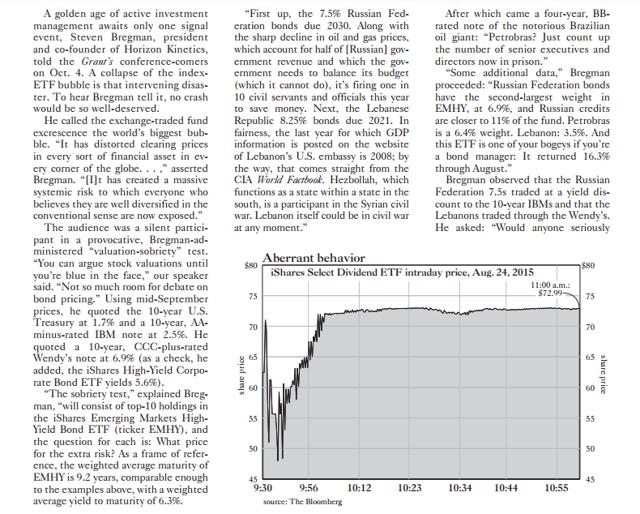

Last week, I was reading, and researching, and I came across an October 14th, 2016 issue of Grant’s Interest Rate Observer, which was a recap of a presentation that Steven Bregman gave at Grant’s October Investment Conference.

I have been a subscriber to Grant’s Interest Rate Observer, and I am a fan of James Grant, who was born in New York City, but attended undergraduate college at Indiana University. Mr. Grant has maintained ties to Indiana, including speaking as a guest speaker at the CFA Society of Indianapolis functions, which I have been involved with as a current member and past board member (I have also been a member of the Chicago CFA Society where Grant’s work has been featured).

This particular issue caught my eye, because it delved into the index/ETF bubble, which has been a topic that I have been writing about, and which I have been thinking about a lot lately.

A Passive Investing ETF Bubble

The opening paragraph describes the topic up for discussion, and the second paragraph spells out the views of Steven Bregman, president and co-founder of Horizon Kinectics, who presented at Grant’s October 4 th, 2016 Investment Conference, and like the famous line from Jerry Maguire, the presentation had me at hello.

Specifically, here is the opening paragraph and then the second paragraph, and then a screen shot that captures the broader discussion.

“A golden age of active investment management awaits only one signal event, Steven Bregman, president and co-founder of Horizon Kinetics, told the Grant’s conference-comers on Oct. 4. A collapse of the index/ETF bubble is that intervening disaster. To hear Bregman tell it, no crash would be so well-deserved

He called the exchange-traded fund excrescence the world’s biggest bubble. “It has distorted clearing prices in every sort of financial asset in every corner of the globe…,” asserted Bregman. “[I]t has created a massive systemic risk to which everyone who believes they are well diversified in the conventional sense are now exposed.”

Re-reading this piece, the amazing thing to be is that the passive investing/ETF bubble appeared to peak in 2016, yet roughly a full year later, the excesses have only been amplified.

No Factor For Valuation = No Price Discovery

The crux of Bregman’s case, and my argument too, is illustrated on page 2 of the linked report. In these paragraphs, he deconstructs the iShares Emerging Market Bonds High Yield ETF (EMHY), and in doing so, he exposed the flaws of indexing, particularly when accomplished through ETF investing. Here is a highlighted portion that I think makes a convincing point.

“By operation of law,” Bregman went on, “new money in EMHY is allocated based on float. In other words, the more debt a nation issues, the greater the allocation to its bonds because it has a greater capitalization. Petrobras (PBR) issues more bonds: greater index weight. Yes. The allocations must be done promptly and according to their precise index weights.

“There is no factor in the algorithm for valuation,” our speaker noted. “No analyst at the ETF organizer—or at the Pension Fund that might be investing—who is concerned about it; it’s not in the job description. There is, really, no price discovery. And if there’s no price discovery, is there really a market? In which case, what is EMHY really worth?

“This is about artificial supply-and demand pressures. Now, take this exercise and apply it to the equity indexes. That’s what’s going on. It’s just tougher to debate.”

The emphasis added through formatting was mine, because that is what is going on in the investment management industry. As the former second CIO I worked under at Oxford aptly discovered, probably from “career threatening” mistakes at his prior CIO position at Okabena, there is no reason to take “career risk” when everybody is embracing the same way of investing, namely passive investing, and investing through ETF’s.

Building on this narrative, active investors, particularly active value investors, who were steamrolled from their purchases of financials and real estate equities in 2008 and 2009, negating their typical out-performance in bear markets, have been unable to serve as a check-and-balance to the “blind” passive money, because they have rapidly gone extinct.

Ultimately, this has harmed price discovery and further distorted valuations.

The ETF Divide

During the conference, Bregman highlighted how ETF’s have influenced stock valuations. One specific example that stands out, and was illustrated, was the impact of ETF’s on Exxon Mobil (XOM). Here are the paragraphs discussing its valuation and price performance from 2013-2016.

“Bregman lingered for a while on Exxon, a kind of ETF Swiss Army knife: “Aside from being 25% of the iShares U.S. Energy ETF, 22% of the Vanguard Energy ETF, and so forth, Exxon is simultaneously a Dividend Growth stock and a Deep Value stock. It is in the USA Quality Factor ETF and in the Weak Dollar U.S. Equity ETF. Get this: It’s both a Momentum Tilt stock and a Low Volatility stock. It sounds like a vaudeville act.”

Bregman proposed a mind experiment: “Say in 2013, on a bench in a train station, you came upon a page torn from an ExxonMobil financial statement that a time traveler from 2016 had inadvertently left behind. There it is before you: detailed, factual knowledge of Exxon’s results three years into the future. You’d know everything except, like a morality fable, the stock price: oil prices down 50%, revenue down 46%, earnings down 75%, the dividend-payout ratio almost 3x earnings. If you shorted, you would have lost money”—because the financial statement didn’t mention the coming bifurcation of the stock market that Bregman called the “ETF divide.”

On one side of the line are the anointed ETF constituent securities; on the other side is everything else.”

Again, the emphasis added was mine, as the impact of ETF investing has been particularly pronounced in the commodities sector, and specifically the energy sector.

The larger market capitalization companies that have dominated the energy ETF’s, notably Exxon and Chevron (CVX), have relatively flourished while most of the mid-capitalization and smaller capitalization equities have been in one of the worst energy equity bear markets in modern market history.

Thus, even relatively large exploration and production companies, like Chesapeake Energy (CHK), and Southwestern Energy (SWN), which are the second and third-largest natural gas producers in the United States, have been cast aside due, in part, to their market capitalization’s, which shrink further as they are not included in the exalted passive indexes and chosen ETFs.

Risk Is Misinterpreted

From my writing, you can already probably tell how much I enjoyed this presentation, and the corresponding write-up.

Here is another nugget, via several paragraphs about risk, specifically related to the REIT sector, think the Vanguard REIT ETF (VNQ), or the iShares U.S. Real Estate ETF (IYR), that I think will hit home for many investors.

“Now came a question: “So how do they—the big ‘they’—address this risk?”

And an answer: “In the financial realm, risk has come to be measured by historical price volatility. Consequently, enormous effort is devoted to finding low-volatility sectors with sufficient liquidity. The most prominent statistic for volatility is beta. Go to Yahoo Finance, type in ‘IBM,’ (IBM) and there, front and center alongside price, market cap and dividend yield, is beta.

“Let’s examine this,” Bregman went on. “The iShares REIT ETF (IYR), with a 2.8% yield—which I personally see as 35x earnings—has a beta of 0.72. That is low-risk by definition. But which beta should be used for that definition? The beta for the three years through August 2016? Why not the beta for the three years to March 2007?

“Because the beta at the end of March 2007 was even better—an incredibly low 0.3—only 30% of the volatility of the S&P 500. By February 2009, two years later, the ETF fell 90%, and even Simon Property Group (SPG) shares fell almost 70%, while the S&P (SPY) fell about 46%.”

The problems that we had evaluating risk in 2007 are even worse today, in my opinion, as correlations are higher, and the amount of listed equities in the United States has shrunk by roughly half.

In summary, the accelerated adoption of passive investing and ETF investing has heightened risks, but investors and speculators do not realize this, because volatility in the markets has been so low, and the lack of draw-downs has provided and eerie calm and complacency that supersedes the 2007 investing landscape, in my opinion.

The Opportunity

For someone who has spent the past 25 years actively investing and speculating, but who has gone through a very rough period of performance, I can empathize with the following quote from the write-up of the conference.

“So much for life on the sunlit side of the ETF divide. What about life in the darkness? “In the past two years,” said Bregman (Author’s Note: Remember this presentation occurred in October of 2016, but the trends have continued through today, nearly a year later), “the most outstanding mutual fund and holding-company managers of the past couple of decades, each with different styles, with limited overlap in their portfolios, collectively and simultaneously under-performed the S&P 500. We’re talking 10 to 20 percentage points in a given year. There is no precedent for this. It’s never happened before.

“It is important to understand why,” he stated. “Is it really because they invested poorly? In other words, were they the anomaly for under-performing—and is it reasonable to believe that they all lost their touch at the same time, they all got stupid together? Or was it the S&P 500 that was the anomaly for outperforming?”

From my perspective, I agree with the bulk of this commentary, with the exception of the comment about the under-performance by the best money managers. It has happened before, and it happened fairly recently, specifically in 2007 and 2008.

During this time-frame, active managers, particularly value managers, under-performed, as traditional bastions of value, notably financial stocks, suffered the worst declines.

I can remember than time-frame clearly, and what I remember is that very few analysts and investors could value anything, similar to today. It was confusing, and confounding, but it offered substantial opportunity, as does the investing environment today.

When valuations have no anchor, prices can fluctuate wildly. For us, as contrarian investors, that means some of our big losers on the year, or since inception, have the potential to rapidly reverse course, but it is hard for us to realize that right now, as we have been battered by the non-stop declines, constant negative news headlines, and price action that is seemingly negative every day and every week.

Conclusion – Embrace Active Investing & Being Different Than The Indexes

Here are some quotes I highlighted in the article, directly from the presentation, which again occurred in October of 2016, but is even more relevant today, in my opinion, and I wanted to list them again, because they provide a conclusion that practically writes itself.

“He called the exchange-traded fund excrescence the world’s biggest bubble. “It has distorted clearing prices in every sort of financial asset in every corner of the globe…,” asserted Bregman. “[I]t has created a massive systemic risk to which everyone who believes they are well diversified in the conventional sense are now exposed.”

“There is no factor in the algorithm for valuation,” our speaker noted. “No analyst at the ETF organizer—or at the Pension Fund that might be investing—who is concerned about it; it’s not in the job description. There is, really, no price discovery. And if there’s no price discovery, is there really a market? In which case, what is EMHY really worth?”

“This is about artificial supply-and demand pressures. Now, take this exercise and apply it to the equity indexes. That’s what’s going on. It’s just tougher to debate.”

“On one side of the line are the anointed ETF constituent securities; on the other side is everything else.”

“Because the beta at the end of March 2007 was even better—an incredibly low 0.3—only 30% of the volatility of the S&P 500. By February 2009, two years later, the ETF fell 90%, and even Simon Property Group (SPG) shares fell almost 70%, while the S&P (SPY) fell about 46%.”

“It is important to understand why,” he stated. “Is it really because they invested poorly? In other words, were they the anomaly for underperforming—and is it reasonable to believe that they all lost their touch at the same time, they all got stupid together? Or was it the S&P 500 that was the anomaly for outperforming?”

From the presentation, its documentation, and my chronicling, and commentary, it should be clear that the markets have reached extremes (they had already reached these extremes in 2016 but have extended these extremes further in 2017), perhaps beyond any prior valuation extremes in modern market history. Absolute valuations certainly rival 1999, but relative valuations between the “have’s” and the “have not’s” is even more pronounced.

The lack of price discovery, and valuation analysis, which is accelerated in a self-reinforcing cycle by the massive fund flows into passive and ETF investing, has created a market that is ripe for price discovery, which should be a dream environment for active investors.

In summary, simply surviving to get to the price discovery phase has been difficult, however the rewards should be similar in magnitude, and perhaps even greater than the 2008/2009 opportunity, which rivals any period of potential returns in modern market history.

To close, the market has a dividing line today, which is even more pronounced than 2016, and the stock market remains extremely bi-furcated. The opportunity lies on the other side of this dividing line, in sectors, like commodity equities, which have very little weight in indexes. Drilling down further, commodity stocks that reside outside the “halo” of wide-scale ETF ownership, offer return potential that is every bit as good as the depressed financial and real estate shares in the Spring of 2009.

Two Research Services

To get in on the ground floor of this opportunity (yes it is still a ground floor, maybe even lower after energy prices bottomed nearly three years ago in 2016), please consider one of the two following research services.

First, is The Contrarian, where we have a live history that actually captured the past significant inflection point in 2015 & 2016. Members can read through posts from that time, see how out-sized returns were achieved, look at what is similar today, and try to apply those past learning lessons to today’s market environment.

Put simply, I really appreciate our group at The Contrarian, many members who I have come to respect, and I am optimistic that we are all going to do very well together in the year ahead, similar to 2016.

We are always looking for new members that can add profitable ideas, or challenge existing ones, so if you fit this criteria, consider signing up. A fair warning, though, our group is like the Marines, only a few, only the strong, can survive.

Second, I have had quite a few requests for a lower-priced, curated research product, a stepping stone to The Contrarian (our goal is that you try our research at a lower price, make money, and then later upgrade to The Contrarian for the more in-depth, interactive experience), and over the last several months, I have slowly put together a more traditional research newsletter.

To celebrate the second official month of this research product, where the goal is deliver one deep-dive article a month via a PDF emailed report (and I believe there are a lot of once in a generation opportunities today), I am offering a 21% discount off of a much lower annual price point. To get this limited-time discounted price, simply use the coupon code “december”.

Ultimately, I think we are now at a major inflection point in the financial markets, highlighted by the price action in October of 2018, and November of 2018, which has been ongoing in slow motion for three years, but which could suddenly accelerate. Being different, being contrarian, has been extremely painful for over two years now, however, resilience and persistence, two necessary qualities for success in contrarian investing and in life in general, in my opinion, are leading to what I believe is an upcoming golden age for active investors.

If you have any questions, send me a direct message at any time,

Travis

P.S. I have learned over my career that handling disappointment, and taking advantage of the resulting opportunity is a crucial skill for investors and speculators. I cannot tell you how often I am disappointed in the investment markets with price action, yet stubbornness, persistence, and hard work often, but not always, result in a favorable situation, like most things in life.

P.S. II With everyone looking for a price dislocation similar to 2007-2009, look for something different to happen, including a potential pick up in inflation and interest rates, which very few are even considering.